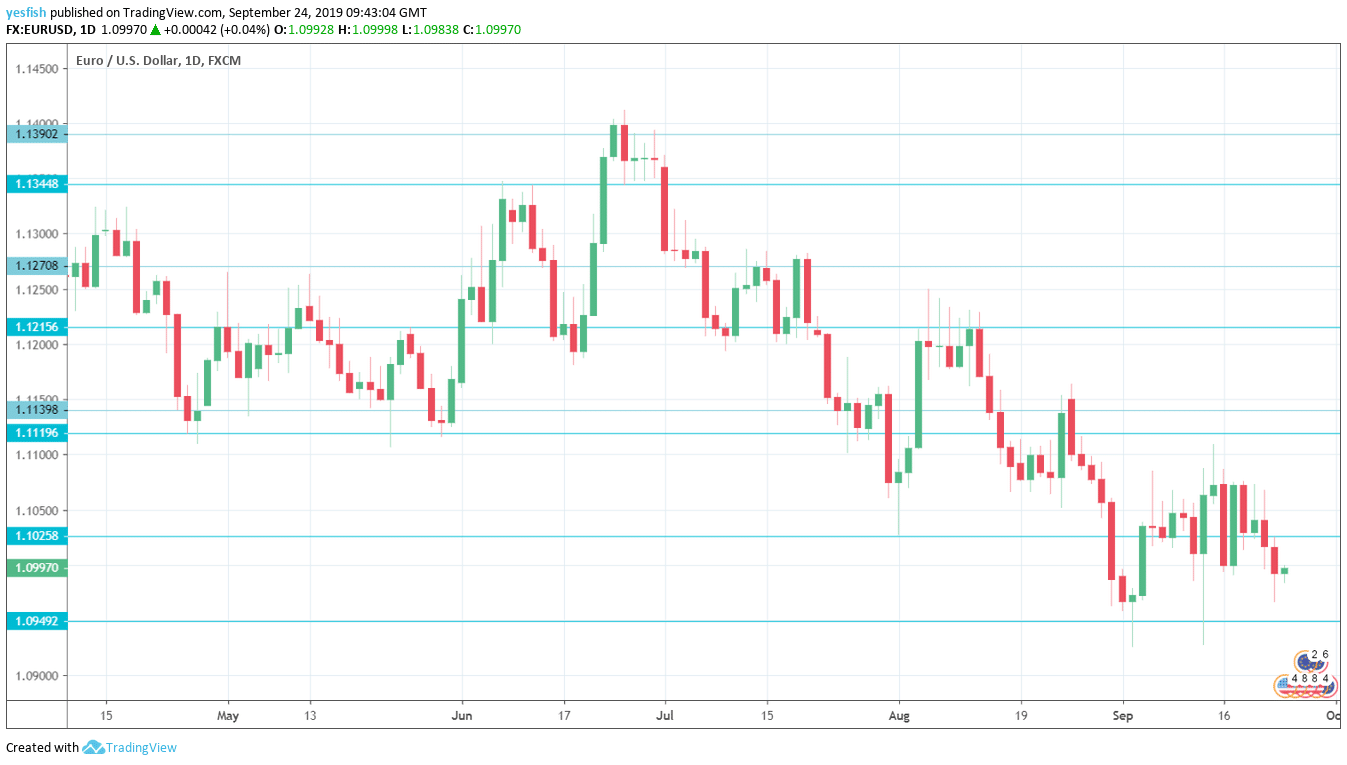

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Flash PMI’s: Monday, 7:15 for France, 7:30 for Germany, and 8:00 for the euro-zone. In France, the Manufacturing Purchasing Managers’ Index improved to 51.0 in August. This points to stagnation in the manufacturing sector. A score of 50.9 is expected in September. The services sector was better off with services PMI standing at 53.3 points. The forecast stands at 53.1. German manufacturing remains in contraction territory and came in at 43.6. The estimate for September is 44.6. Germany’s services PMI stood at 54.4 last month and 54.3 is expected. The eurozone as a whole had a manufacturing PMI score of 47.0 points with 47.6 now projected. Eurozone services PMI improved to 53.4 and the forecast stands at 53.1.

- German Ifo Business Climate: Tuesday, 8:00. Business confidence dipped to 94.3 in August and little change is expected in September, with an estimate of 94.5.

- German GfK Consumer Climate: Wednesday, 6:00. Consumer confidence has been steady, with two straight readings of 9.7. No change is expected in the upcoming release.

- Monetary Data: Thursday, 8:00. M3 Money Supply improved to an annual growth rate of 5.2% in July, up from 4.5% a month earlier. The August estimate stands at 5.1%. Private Loans ticked higher to 3.4% in July on an annualized basis.

- French Consumer Spending: Friday, 6:45. Consumers in the second-largest economy in the euro-zone rebounded in July, with a gain of 0.4%. Will we see another gain in August?

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1390.

1.1345 is next. 1.1290 has held in resistance since the first week of July.

Close by, 1.1270 was a double-bottom in December 2018.

1.1215 is the next resistance line.

1.1119 (mentioned last week) is next.

1.1025 remained relevant last week and is a weak resistance line.

1.0950 is providing support.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

I remain bearish on EUR/USD

The eurozone continues to struggle, as weak global conditions and the U.S-China trade war have taken a heavy toll on the manufacturing sector in Germany and the rest of the bloc. If the U.K. leaves Brexit without a deal, the EU economy will also be affected and this could dampen sentiment towards the euro.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!