- EUR/USD has been rising as US yields lose ground.

- Concerns about overheating of the US economy have subsided, leaving room for lower rates.

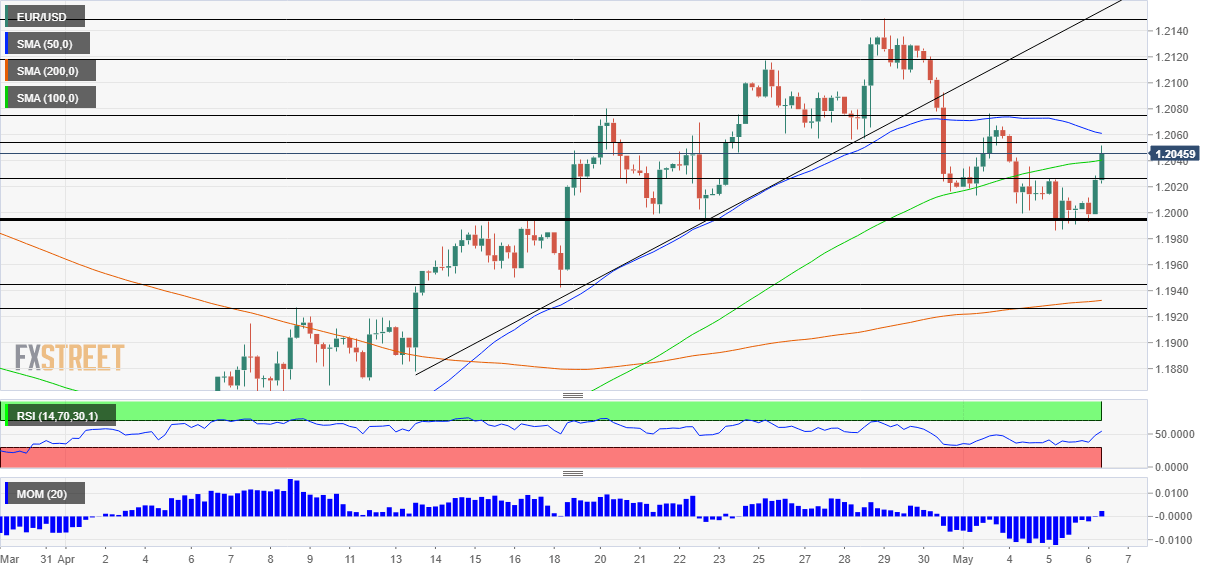

- Thursday’s four-hour chart is pointing to further gains.

Short memory – markets seem to have forgotten Treasury Secretary Janet Yellen’s comments on potentially higher interest rates and are rising again. For the safe-haven dollar, it implies a downfall. Investors have refocused on messages from Federal Reserve officials, who stick to the dovish message that inflation is transitory and that the economy has a long way to go.

Eric Rosengren of the Boston Fed and Lauretta Mester of Cleveland – the latter a known hawk – retreated that message. The data suggests that a shortage in skilled workers and bottlenecks in supply chains could cause prices to rise. However, these are supply issues, not demand ones – therefore “good problems” to have.

The imbalance between supply and demand may result in another outcome – less production rather than higher prices. If the economy adjusts by slowing down, that implies the Fed can continue buying bonds at $120 billion/month for longer. The dollar has more room to fall.

The latest evidence of such a cooldown came from the ISM Services Purchasing Managers’ Index, which dropped to 60.7 in April, below expectations. The figure for America’s largest sector implies a robust expansion, but not overheating. ADP’s private-sector labor market figures also fell short of estimates with under 800,000 new positions. Both publications lower expectations for Friday’s Nonfarm Payrolls report.

US Services and Manufacturing PMI, ADP Employment: Disappointment is relative

The vaccination picture is also shifting in favor of the euro. The old continent is ramping up its immunization effort, with around 30% of Europeans already having received their first shot. The US is still ahead with 45%, but the gap is narrowing.

All in all, fundamentals allow for further gains.

EUR/USD Technical Analysis

Euro/dollar has topped the 100 Simple Moving Average on the four-hour chart and momentum has flipped to the upside – both bullish developments. It is still below the 50 SMA , which is the first resistance line, at 1.2060.

Further above, 1.2080, 1.2120 and 1.2150 await the currency pair.

Support is at 1.2025, a swing low from last week, followed by 1.1990 and 1.1945.