- EUR/USD remains apathetic in the 1.1900 neighbourhood.

- The dollar alternates gain with losses ahead of US CPI.

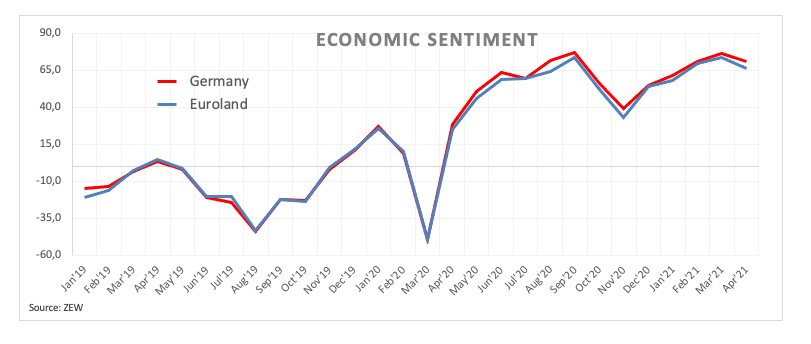

- German, EMU Economic Sentiment deflates in April.

EUR/USD so far manages well to keep business around the key 1.1900 region on turnaround Tuesday.

EUR/USD now looks to US data

EUR/USD gyrates around the 1.19 hurdle following earlier lows in the proximity of 1.1880 amidst the generalized inconclusive price action surrounding spot as well as the absence of catalysts.

In the meantime, the shared currency stays apathetic after the ZEW survey for the month of April showed the Economic Sentiment in both Germany and the euro area deflated to 70.7 and 66.3, respectively. Both prints came in short of estimates and note some cooling in investors’ morale in the region.

In the meantime, the prevailing side-lined theme is forecast to persist until at least the release of key US inflation figures for the month of March later in the NA session.

What to look for around EUR

EUR/USD puts the 1.1900 level to the test, although the lack of a strong catalyst prevents the pair to extend the move further north. The near-term outlook for the pair, however, looks improved on the back of rising hopes of a sustained recovery in the Old Continent now that the vaccine rollout appears to have gained some serious pace.

Key events in the euro area this week: Industrial Production, Lagarde speech (Wednesday) – German final March CPI (Thursday) – Eurogroup meeting, EMU final CPI (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund.

EUR/USD levels to watch

At the moment, the index is losing 0.10% at 1.1898 and a breach of 1.1704 (2021 low Mar.31) would target 1.1602 (monthly low Nov.4) en route to 1.1570 (2008-2021 support line). On the upside, the next up barrier is located at 1.1927 (weekly high Apr.8) followed by 1.1989 (weekly high Mar.11) and finally 1.2000 (psychological level).