- The pair moves higher to the 1.1640 region, session tops.

- The greenback remains on the defensive with DXY around 94.30.

- German flash May CPI figures next on tap ahead of US ADP.

The renewed bid tone around the single currency is now lifting EUR/USD to test fresh daily highs in the 1.1635/40 band ahead of key data releases in Germany and the US.

EUR/USD looks to German, US data

The pair seems to have recovered the smile on Wednesday, regaining the key barrier at 1.1600 the figure after recording fresh multi-month lows in the 1.1500 neighbourhood during the first half of the week.

The ongoing squeeze higher in spot comes amidst a wave of selling orders hitting the buck and dragging the US Dollar Index (DXY) further south of recently recorded YTD peaks just beyond the 95.00 milestone.

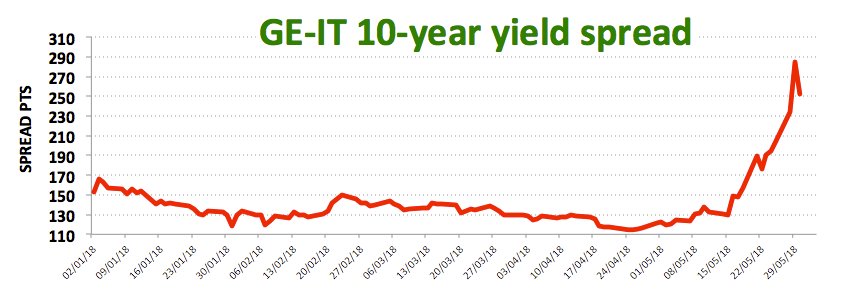

However, the extent and sustainability of the current up move in the pair remains to be seen, as political uncertainty in Italy remains far from abated. In this regard, and in light of snap elections due at some point in late July, latest polls showed far-tight Lega Nord with more than 25% of vote intentions, that is even more what the party obtained in the last elections.

Later in the day, German advanced inflation figures for the current month are due next, followed by US ADP report and another revision of US GDP for the January-March period.

EUR/USD levels to watch

At the moment, the pair is up 0.84% at 1.1633 facing the next resistance at 1.1701 (10-day sma) seconded by 1.1718 (monthly low Dec.12 2017) and finally 1.1808 (21-day sma). On the flip side, a break below 1.1511 (2018 low May 29) would target 1.1479 (low Jul.20 2017) en route to1.1373 (low Jul.13 2017).