- The Federal Reserve has countered its rate cut with a confident message.

- Fed Chair Jerome Powell has extended the dollar gains with three critical comments.

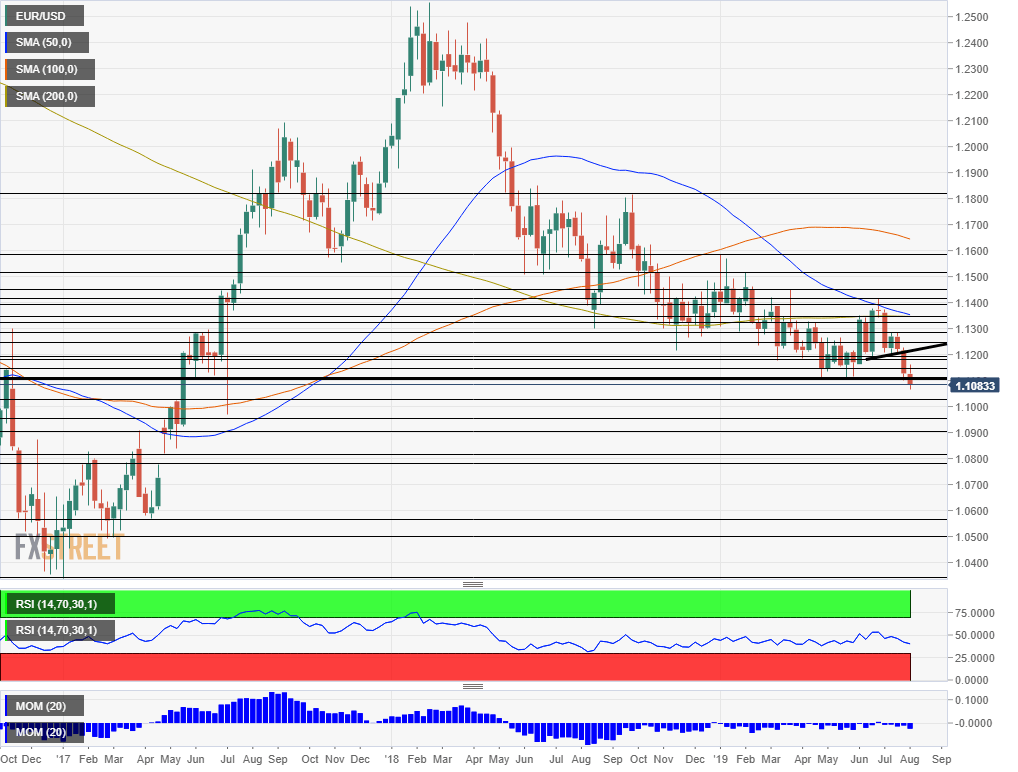

- EUR/USD has fallen to the lowest in two years and eyes critical levels below.

The confident message in the Fed statement – expressing confidence on inflation, employment and the two dissenters – was only the beginning. FedChair Jerome Powell has been sending the dollar even higher – and stocks lower.

Here are Powell’s critical comments:

1) An insurance aspect: The Fed Chair has said that “there is definitely an insurance aspect to it.” Powell echoes his colleague James Bullard, President of the Saint Louis branch of the Federal Reserve. Bullard – and now Powell – are conveying a message that it is just an adjustment against downside risks – not a long-term move.

2) Clarifying it is not the beginning of a cycle: Powell has proved that he is a straight talker. While he has refrained from ruling out further cuts, he clarified it is “not a cycle” similar to ones seen in a recession. He classified it as an “adjustment.”

3) Committee still sees a favorable outlook: The bottom line is positive with upbeat prospects for the economy despite risks coming from weaker global growth and subdued inflation.

EUR/USD levels to watch

EUR/USD has hit a low of 1.1064 at the time of writing – the lowest since May 2017. This temporary low is the first support line.

Further down, we are looking at levels dating back to 2017 and beforehand. 1.1025 is the next level to watch after served as resistance in May 2017. Next, we find 1.0960 which worked as resistance in April that year.

The round number of 1.0900 was a swing high in March 2017 and is a critical level.

The next two lines mark a gap line from April that year: 1.0810 and 1.0790 – related to the victory of Emmanuel Macron in the French presidential elections.

The next line is much lower – 1.0570 has been the lowe point in April 2017. t is followed by 1.0500 which was a double-bottom back in March that year. The final line to watch is 1.0340 – seen in January 2017 and the lowest since 2003.