- EUR/USD gives away initial gains and retreats to the low-1.2100s.

- The dollar reverses losses and regains upside traction on Wednesday.

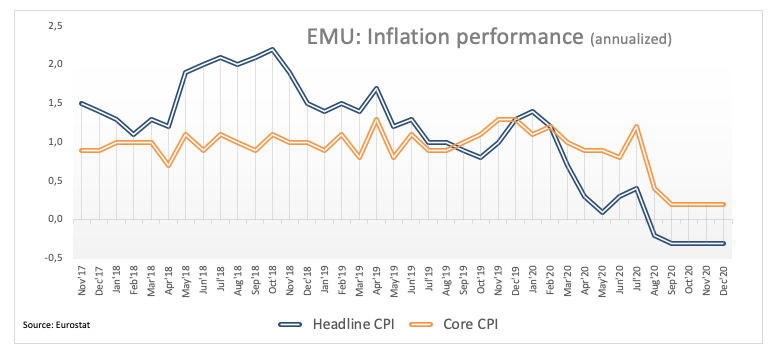

- EMU’s December final CPI dropped 0.3% from a year earlier.

The single currency fades the initial optimism and now motivates EUR/USD to retreat to the vicinity of the 1.2100 area, or session lows.

EUR/USD looks to risk trends, Biden

EUR/USD appears to have resumed the downside and returns to the negative territory after failed to extend the recovery past the 1.2155/60 band during early trade.

In fact, the greenback reclaims some shine lost in past hours despite US yields continue to navigate within a rangebound mood in sub-1.10% levels.

Further out, investors are expected to closely follow the US political scenario later today, where Joe Biden will swear as the 46th US President.

In the euro docket, the final inflation figures in the broader Euroland showed headline consumer prices contracted at an annualized 0.3% in December. Core prices, instead, advanced 0.2% from a year earlier.

Later in the US docket, MBA will release its weekly Mortgage Applications followed by the NAHB Index and the API’s report on crude oil supplies.

What to look for around EUR

The leg lower in EUR/USD seems to have met decent contention in the mid-1.2000s for the time being. Despite the recent corrective downside, the outlook for EUR/USD remains constructive and appears supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the pair is down 0.08% at 1.2119 and a break above 1.2173 (23.6% Fibo of the November-January rally) would target 1.2349 (2021 high Jan.6) en route to 1.2413 (monthly high Apr.17 2018). On the flip side, the next support is located at 1.2054 (55-day SMA) seconded by 1.2053 (2021 low Jan.18) and finally 1.1976 (50% Fibo of the November-January rally).