- EUR/USD has been consolidating above 1.1200 amid Trump’s trade wars

- The focus is shifting to the all-important ECB meeting that may paint a darker picture of the economy.

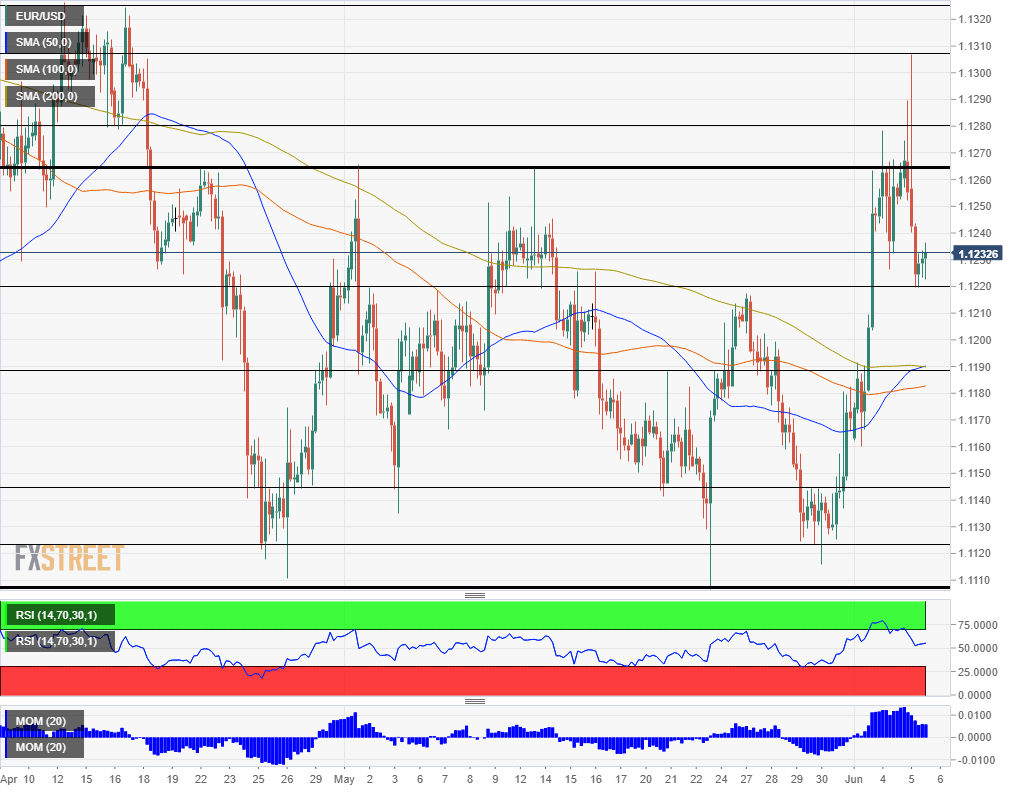

- Thursday’s four-hour chart shows a critical support confluence below 1.1200.

EUR/USD has been unable to hold onto the highs and finds itself vulnerable ahead of the European Central Bank’s decision – which may bring it lower.

Midday on Wednesday, the world’s most popular currency pair was enjoying a seven-week high. The US ADP NFP showed a meager gain of only 27K positions – the lowest since March 2010 – sending the US dollar sharply lower. However, the greenback swiftly recovered after the ISM Non-Manufacturing PMI beat expectations with 56.9 points – reflecting accelerating growth in America’s services sector.

The dollar has been extending its gains since then, buoyed by safe-haven flows stemming from the inconclusive talks between the US and Mexico. US President Donald Trump has said that his southern neighbor’s efforts were “not enough” while Mexico remained hpeful for a resolution in the next meeting due later today. The US intends to slap its trading partner with a flat 5% tariff on all goods as early as Monday if border control issues are not resolved.

Trump has also repeated his intention to hit China with new tariffs – on $300 billion worth of Chinese goods – while saying that China badly wants a deal. The world’s second-largest economy said it will consider counter-measures in due time.

And now, all eyes are on the ECB. The Frankfurt-based institution holds today’s rate decision in Vilnius, Lithuania – but the different location is unlikely to lift their spirits. Apart from trade tensions, the central bank has been coping with lower inflation. The preliminary figures for May have disappointed with 1.2% year on year – far from the ECB’s 2% target.

The bank will present the details of its new, low-interest funding scheme called TLTRO. For euro traders, the focus is on the new growth and inflation forecasts – minor downgrades are projected. The ECB may surprise by changing its guidance regarding interest rates which it plans to raise early next year according to after originally laying out a plan for a hike for “after the summer”.

Another pushback in guidance cannot be ruled out – and the euro may suffer.

See ECB Preview: Three things that may tilt EUR/USD to the downside

After the dust settles from the ECB meeting, John Williams, President of the New York branch of the Federal Reserve, will speak. Williams – so far one of the optimistic at the bank – may sound more dovish by echoing the words of Chair Jerome Powell that opened the door to rate cuts.

EUR/USD Technical Analysis

EUR/USD has lost some of the upward momentum and the Relative Strength Index (RSI) has lost ground as well. That has happened after the failure to conquer the former triple-top of 1.1265.

Support awaits at 1.1220 which was a low point earlier in the day. More importantly, critical support awaits at 1.1190 which is the confluence of the 50, 100, and 200 Simple Moving Averages on the four-hour chart – as well as a swing high in late April – thus a critical confluence.

Further down, 1.1145, 1.1125, and the 2019 low of 1.1107 await the pair.

Above 1.1265, EUR/USD faces resistance at 1.1280 which served as support in mid-April. It is followed by 1.1310 which was the peak on Wednesday, and by 1.1325, the high point in April.