- EUR/USD drops to 3-day lows near 1.2080 on Monday.

- The risk aversion mood supports the demand for the dollar.

- German Industrial Production expanded 3.2% MoM in October.

The single currency adds to Friday’s corrective downside and drags EUR/USD to fresh lows in the sub-1.2100 area on Monday.

EUR/USD in 3-day lows

EUR/USD drops for the second session in a row at the beginning of the week and breaches the key barrier at 1.21 the figure on the back of the resumption of the risk-off sentiment among market participants.

In addition, the euro is suffering some profit taking mood as investors continue to cash out part of the recent strong gains in the pair. It is worth recalling that spot gained more than 5 cents since the start of November until last Friday.

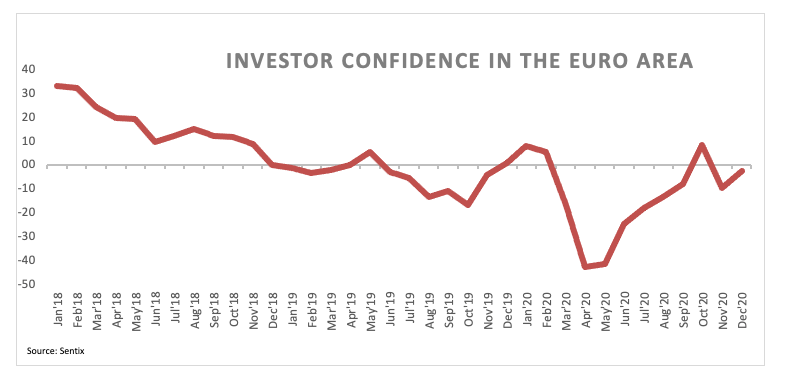

In the euro docket, the German Industrial Production surprised to the upside and expanded 3.2% from a month earlier in October. Also adding to the upbeat results in the region, the Sentix index – which tracks the Investor Confidence – came in at -2.7 for the current month.

Across the pond, the only release later on Monday will be the October’s Consumer Credit Change.

What to look for around EUR

The upside momentum in EUR/USD faltered in the proximity of the 1.22 barrier in past sessions, always against the backdrop of the favourable context in the risk complex. In the very near-term, EUR/USD appears supported by prospects of a strong recovery in the region along with the increasing likelihood of extra stimulus in the US. Risks to this positive view emerge from the potential political effervescence around the EU Recovery Fund and increasing chances of further ECB easing to be announced as soon as at the December meeting.

EUR/USD levels to watch

At the moment, the pair is losing 0.26% at 1.2089 and faces the next support at 1.1920 (high Nov.9) seconded by 1.1800 (low Nov.23) and finally 1.1745 (weekly low Nov.11). On the other hand, a breakout of 1.2177 (2020 high Dec.4) would target 1.2413 (monthly high Apr.17 2018) en route to 1.2476 (monthly high Mar.27 2018).