- The pair loses upside momentum in fresh lows around 1.1720.

- The greenback manages to stage a rebound from lows near 93.70.

- Advanced EMU CPI expected at 1.9% in May. Core CPI at 1.1%.

After testing fresh tops in the 1.1720 region earlier in the day, EUR/USD met some selling orders and is now returning to the 1.1680/75 band.

EUR/USD upbeat on Italy, looks to US data

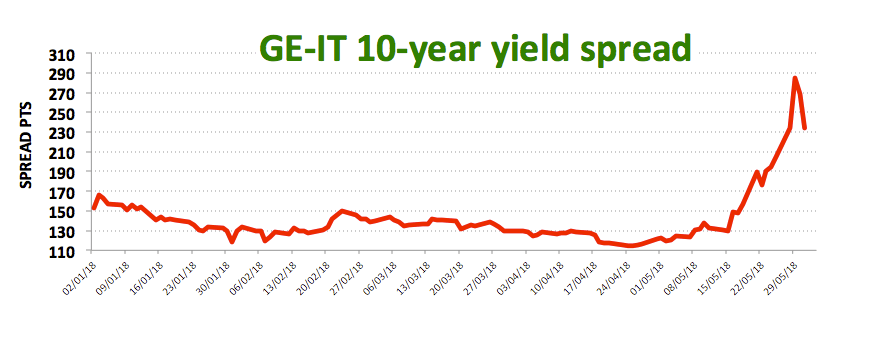

Spot is up for the second consecutive session so far on Thursday, extending the rebound from Tuesday’s 11-month lows in the 1.1500 zone. Some renewed optimism in the Italian political scenario, declining yields in the Italian money markets and a correction higher in stocks are all collaborating with the upbeat momentum in EUR.

In addition, advanced inflation figures in the euro area now see consumer prices rising at an annualized 1.9% during May, while prices stripping food and energy costs are seen up to 1.1%, both prints coming in above previous estimates and thus lending extra oxygen to the shared currency.

Later in the NA session, the focus should be on the buck in light of the publication of PCE figures for the month of April, weekly Initial Claims, Pending Home Sales and Personal Income/Spending.

Furthermore, FOMC’s L.Brainard and R.Bostic are due to speak.

EUR/USD levels to watch

At the moment, the pair is up 0.16% at 1.1682 facing the next resistance at 1.1724 (high May 31) seconded by 1.1797 (21-day sma) and finally 1.1830 (high May 22). On the flip side, a break below 1.1511 (2018 low May 29) would target 1.1479 (low Jul.20 2017) en route to1.1373 (low Jul.13 2017).