- EUR/USD fades the uptick to 1.1030/35.

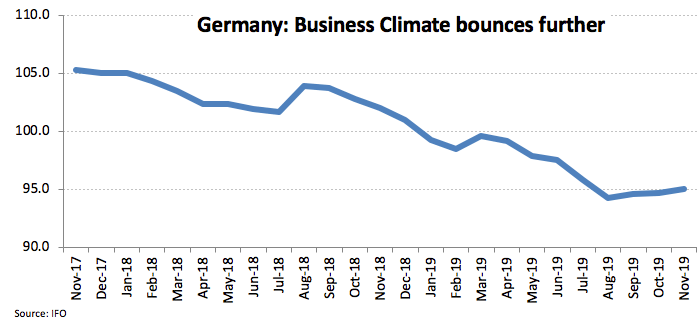

- German Business Climate matched estimates at 95.0.

- Bund 10-year yield advances to -0.35%.

EUR/USD is now returning to the 1.1020 region after failing to sustain the earlier advance to session highs in the 1.1030/35 band.

EUR/USD upside still capped by the 55-day SMA

Spot is now losing some upside momentum after the German IFO survey failed to surprise investors on Monday.

In fact, the pair remained apathetic after the German Business Climate improved marginally to 95.0 for the current month and the Current Assessment came in at 97.9, both prints matching initial estimates. On the downbeat side, Business Expectations came in at 92.1, missing consensus albeit also improving a tad from October’s 91.6.

Later in the week, investors’ attention is expected to be on the preliminary inflation figures in both Germany and the broader euro area for the month of November.

What to look for around EUR

Spot has been rejected from the vicinity of the 1.1100 barrier once again last week, sparking the subsequent knee-jerk to the vicinity of the critical support at 1.10 the figure. As always, EUR is expected to keep tracking trade headlines and USD-dynamics for the time being. On the more macro view, the outlook in Euroland remains fragile and does nothing but justify the ‘looser for longer’ monetary stance by the ECB and the cautious view on the European currency in the medium term. In this regard, latest estimates from manufacturing PMIs in the euro region hint at the likeliness that the sector appear to have bottomed out, although the contagion to the services sector looks more evident as it gained extra pace.

EUR/USD levels to watch

At the moment, the pair is gaining 0.02% at 1.1020 and faces the next hurdle at 1.1083 (100-day SMA) followed by 1.1097 (monthly high Nov.21) and finally 1.1171 (200-day SMA). On the downside, a break below 1.0989 (monthly low Nov.14) would target 1.0925 (low Sep.3) en route to 1.0879 (2019 low Oct.1).