- EUR/USD has been trading closer to 1.1200 as the ECB contemplates resuming QE.

- Fed Chair Jerome Powell’s public appearances are highly anticipated.

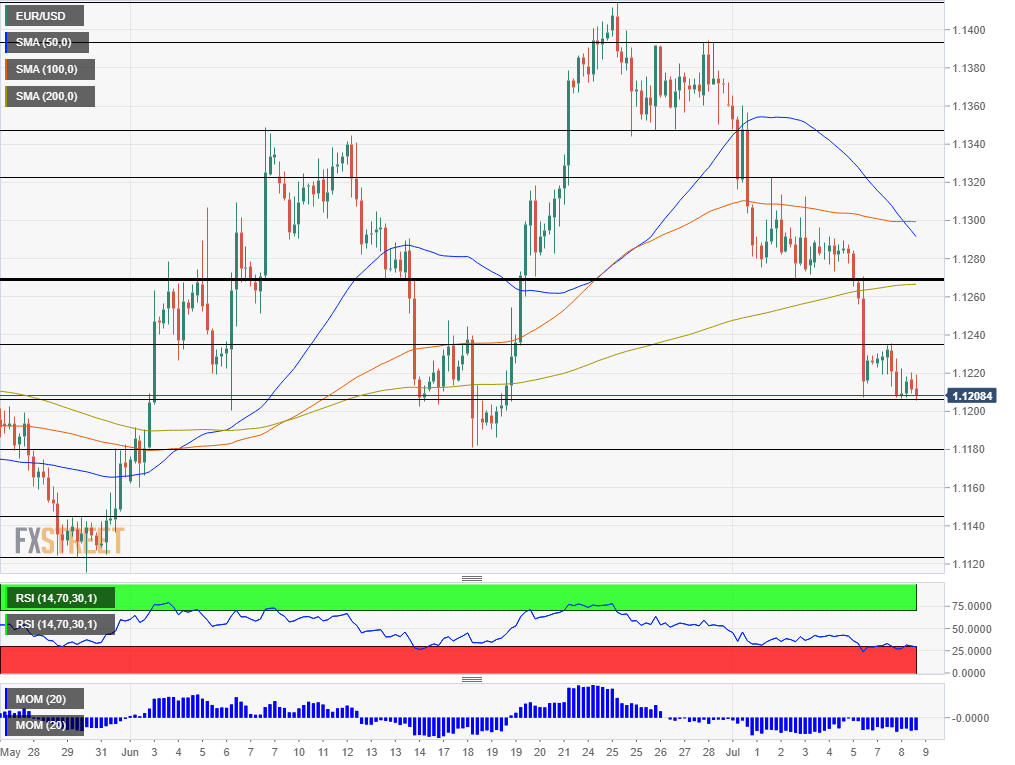

- Tuesday’s four-hour chart shows EUR/USD is experiencing oversold conditions – implying a bounce.

EUR/USD has been leaning lower – and for good reasons. Dark clouds are gathering over Europe and the European Central Bank is ready to react. The latest depressing sign came from the Sentix Business Investor Confidence. The 2,800-strong survey has dropped to -5.8 points – expressing growing pessimism – and also falling below expectations.

Markets have been pricing in a rate cut from the ECB that may probably come in September. However, several comments from commercial banks have been showing that markets project that the Frankfurt-based institution will do more. A resumption of Quantitative Easing – or money printing – has seen rising chances. A new scheme may significantly weaken the common currency.

Phillip Lane, the ECB’s chief economist, will respond to questions via Twitter at 14:15 GMT. His influence is seen as rising when the Christine Lagarde, Managing Director of the International Monetary Fund, is set to become ECB President in November. Lagarde is not an economist and she will likely rely on Lane’s expertise. His thoughts about future monetary policy may move markets.

And while the euro is leaning lower on such speculation, the moves are limited due to tension related to the central bank on the other side of the pound. Jerome Powell, Chair of the Federal Reserve, will deliver a speech later today – but will probably refrain from delving into monetary policy as that will be on the agenda in his critical testimony before Congress on Wednesday.

Investors wish to know if the Fed will cut rates only once later this month or embark on a long cycle of loosening monetary policy. Recent US data have been upbeat – reducing expectations for a rate cut and pushing the dollar higher.

The US JOLTs job openings and the NFIB Small Business Index will be of interest but the focus is set to remain on central banks.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart is below 30 – indicating oversold conditions and a potential bounce from current levels. Moreover, EUR/USD has been setting lower highs – another positive sign.

However, momentum remains negative and the world’s most popular currency pair continues trading below the 50, 100, and 200 Simple Moving Averages on the four-hour chart – all bearish signs.

Initial support awaits at 1.1205, today’s low. It is followed by 1.1180, which was a swing low in mid-June. 1.1145 and 1.1120 defined a lower trading range that EUR/USD was confined to in late May. 1.1107 which is the 2019 low, is the next line to watch.

Resistance awaits at 1.1130, which held the pair down on Monday. 1.1270 served as support last week, and 1.1320 was a swing high around the same time. 1.1345 and 1.1390 are next