- EUR/USD adds to Thursday’s losses well below 1.2300.

- The dollar’s rebound keeps weighing on the pair.

- US Nonfarm Payrolls, jobless rate next of relevance in the docket.

The offered bias remains well and sound around the single currency and drags EUR/USD to fresh lows in the 1.2215/10 band at the end of the week.

EUR/USD bounces off multi-day lows

EUR/USD is down for the second session in a row on Friday, although it has managed to regain some composure following earlier multi-day lows near the key support at 1.2200 the figure.

The recent pick up in US yields has been collaborating with the better note surrounding the greenback, which in turned put the risk complex under extra pressure and forced the riskier assets to fade part of the gains seen in past sessions.

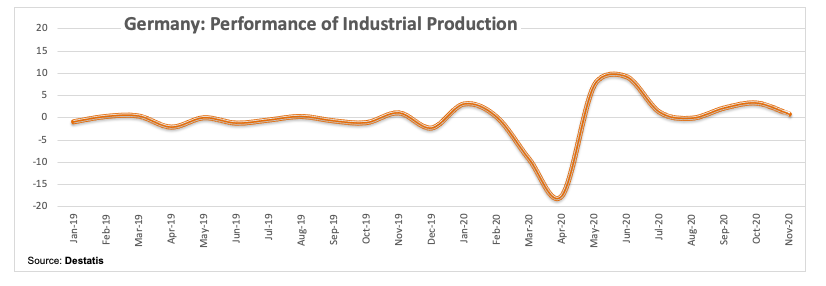

In the euro docket, German Industrial Production expanded at a monthly 0.9% in November while the trade surplus shrunk a tad to €16.4 billion in the same period.

In the US data space, the crucial monthly report on the labour market is due. Consensus expects the US economy to have added just 71K jobs in December and the Unemployment Rate to have advanced to 6.8% (from 6.7%). Other data include Wholesale Inventories and Consumer Credit Change for the month of November and the speech by FOMC’s R.Clarida (permanent voter, dovish).

What to look for around EUR

The upside momentum in EUR/USD run out of steam in the 1.2350 area for the time being followed by a moderate correction lower. In spite of the corrective downside, the outlook for EUR/USD remains constructive and appears supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the pair is retreating 0.24% at 1.2240 and faces immediate contention at 1.2129 (weekly low Dec.21) seconded by 1.2058 (weekly low Dec.9) and finally 1.2032 (23.6% Fibo of the 2017-2018 rally). On the other hand, a breakout of 1.2349 (2021 high Jan.6) would target 1.2413 (monthly high Apr.17 2018) en route to 1.2476 (monthly high Mar.27 2018).