- EUR/USD has been under pressure due to Europe’s slow vaccination campaign and dollar strength.

- US Nonfarm Payrolls and further jab jitters are set to rock markets.

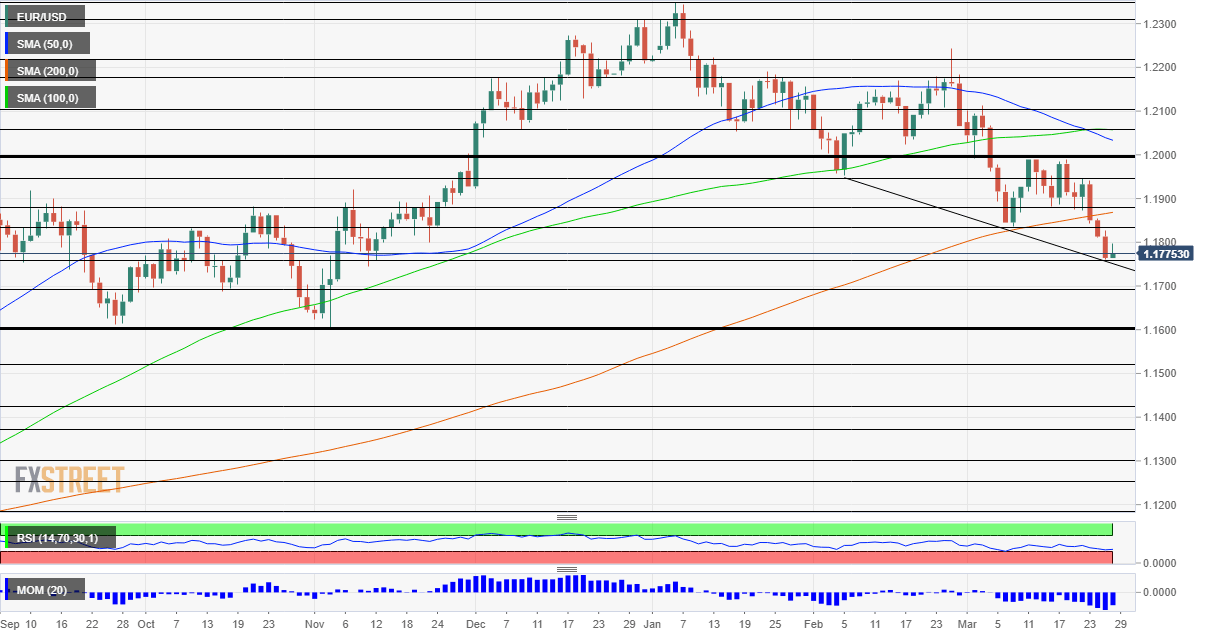

- Late March’s daily chart is painting a mixed picture.

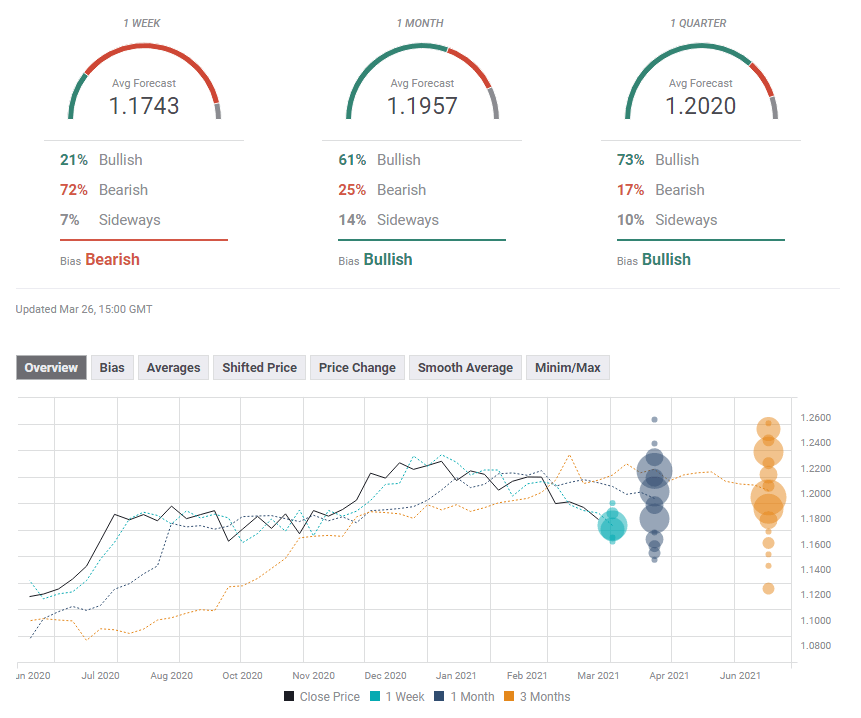

- The FX Poll is pointing to short-term losses and fresh gains later on.

The perfect spring storm – Europe’s worsening covid conditions and another upcoming US infrastructure boost have kept immense pressure on EUR/USD. Will it continue? Nonfarm Payrolls and immunization issues stand out as March draws to an end.

This week in EUR/USD: Vaccine nationalism and breaking correlations

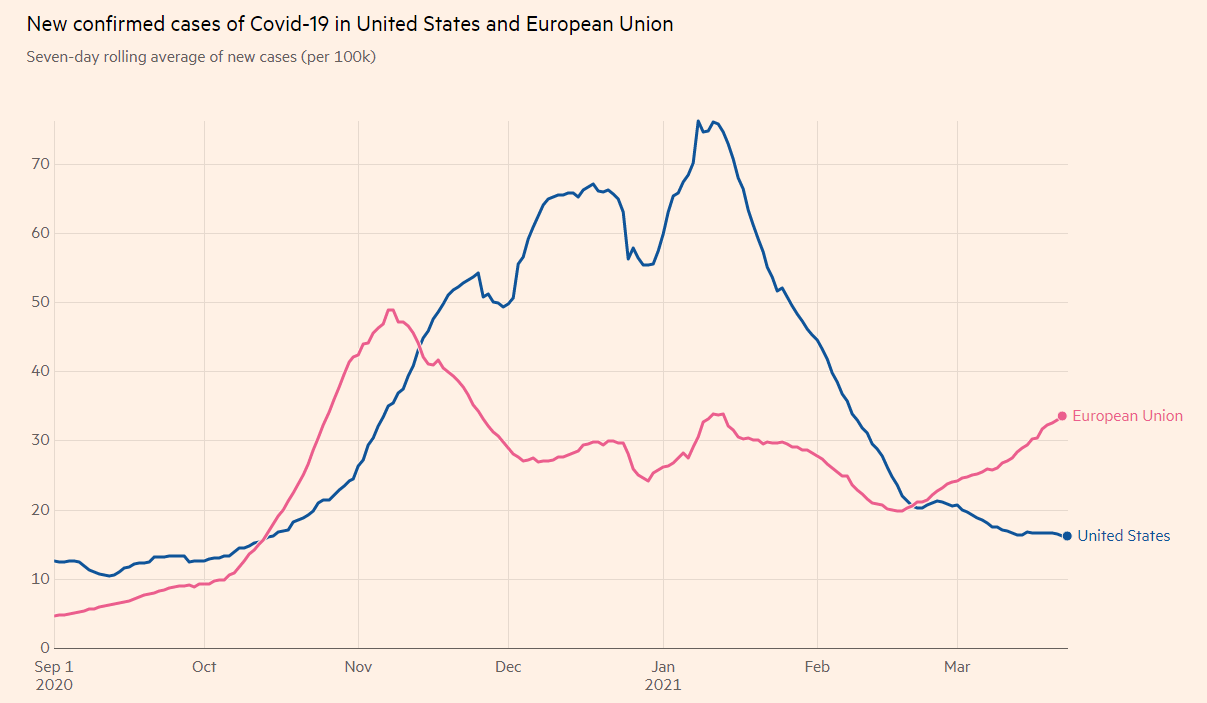

Coronavirus issues from A to Z: COVID-19 cases are rising in the old continent, and it has been weighing on the euro. After Italy and France imposed new restrictions on most of their populations, Germany extended its lockdown through April 18 – yet backtracked on slapping “quiet days” around Easter. The British B 1.1.7 variant is hitting the continent hard.

Infections are rising in Europe:

Source: FT

While the current lockdowns mean a return to normal will have to wait, Markit’s Purchasing Managers’ Indexes for March showed businesses are seeing through the current hardship and looking toward recovery.

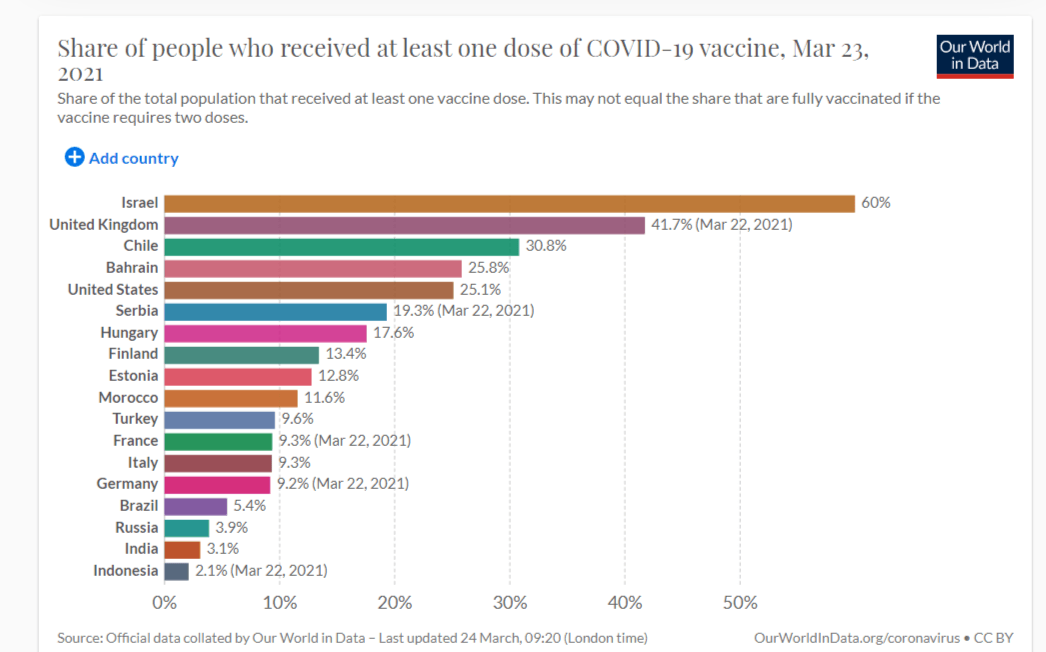

The EU has continued clashing with the UK around AstraZeneca’s vaccines. After the European Medicines Agency gave the green light to the jabs, Brussels threatened to hold back shipments of doses made in the continent to Britain. Tensions have intensified as Europe continues lagging behind both the UK and the US in vaccinations.

Europe’s large economies have inoculated barely 10% of their populations:

Source: OurWorldInData

On the other side of the pond, Treasury yields took a breather from rising, but President Joe Biden’s new plans have been boosting the dollar. According to reports, the White House’s new infrastructure spending program will be gargantuan – $3 trillion dollars – but funding would partially come from tax hikes.

Higher rates for corporates pushed stocks lower and investors into the safe-haven dollar. Moreover, prospects of lower debt issuance mean fewer available bonds, thus a higher value for bonds and lower returns on Uncle Sam’s debt. The dollar-yield correlation seems broken.

Why the dollar is rising while yields are falling – Blame it on the taxman

Jerome Powell, Chair of the Federal Reserve, reiterated his position that higher inflation will likely be temporary while the real unemployment rate remains elevated. He testified alongside Treasury Secretary Janet Yellen, who refrained from talking about President Joe Biden’s spending plans.

US data has been mixed, with Durable Goods Orders disappointing with a drop in February, following the lead of retail sales. On the other hand, the housing sector continued booming last month, with elevated new and existing home sales reflecting activity.

Overall, the euro suffered from its virus situation, while the dollar benefited from safe-haven flows more than from rising yields.

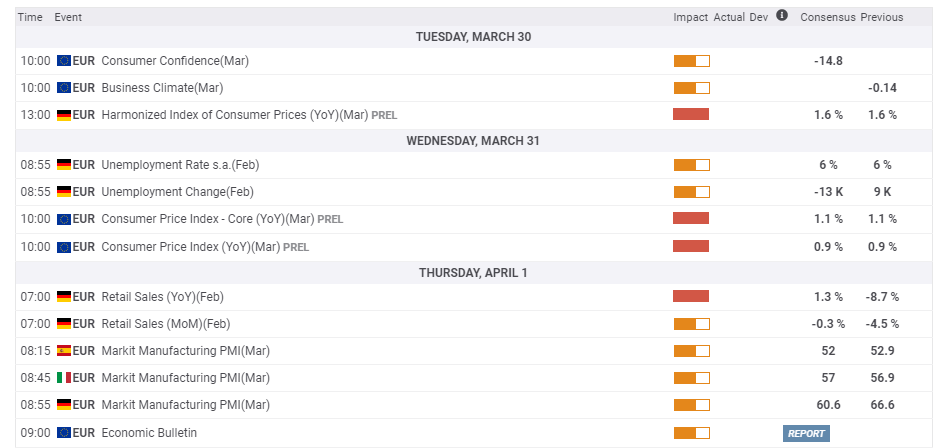

Eurozone events: Virus vs. vaccines

As the virus continues raging in the old continent, statistics in Germany, France, Italy and Spain remain critical to the euro. The uptrend will likely continue for at least another week, as recent measures take time to bring down the caseload. Moreover, the population is frustrated and is likely to flout the rules.

Vaccine deliveries and distribution are also closely watched amid the recent rows with Britain and AstraZeneca. The EU is set to receive new deliveries from all companies – including Johnson & Johnson’s single shot – during April. Any updates may move markets. So far, Europe’s campaign has been hobbled by delays.

The highlight of the economic calendar is the initial release of Consumer Price Index statistics for March, which are set to remain subdued despite the recent bump. The European Central Bank does not foresee inflation coming anytime soon.

Markit’s final manufacturing PMIs are also of interest. It is essential to note that most of Europe will be on holiday on Good Friday, and trading volume may already begin to thin down on Thursday.

Here are the events lined up in the Eurozone on the forex calendar:

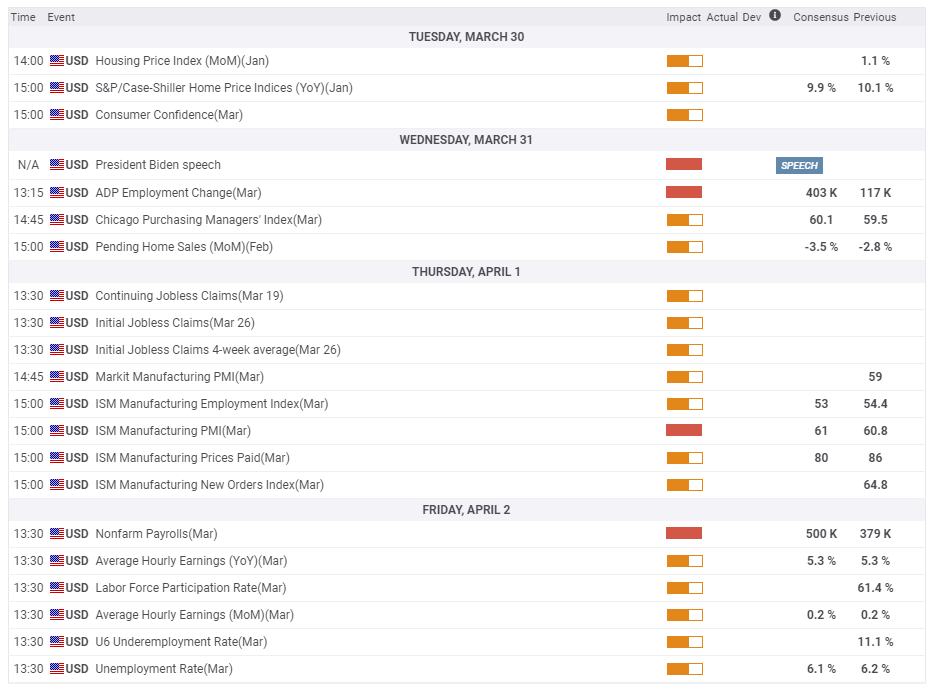

US events: Infrastructure details and Nonfarm Payrolls

New taxes for Uncle Sam? That is the question on many investors’ minds as they await Biden’s economic speech on Tuesday. He is set to lay out infrastructure plans, which may include details on both spending and income. Markets may shiver in response to higher taxation and that would boost the safe-haven dollar.

On the other hand, a two-pronged legislative program that does not include new taxes in its first phase will likely be welcomed by Wall Street. Regarding infrastructure, that would undoubtedly be positive for the economy and may even push inflation higher and the Fed to raise rates sooner- a dollar positive move. All in all, it seems like a win-win situation for the greenback.

Good Friday features the Nonfarm Payrolls report for March, with expectations rising to half a million new positions after February’s robust jump of 379,000 jobs. As many parts of the world will be away for Easter, thin liquidity may cause choppier reactions than usual.

Economists expect the Unemployment Rate to fall to 6.1%, but if the Fed disregards this figure, investors will likely follow – especially if the participation rate remains low. Around 61.4% of Americans are participating in the workforce, in comparison to 63% before the pandemic.

Ahead of the NFP, ADP’s labor figures will help shape expectations – despite missing the mark in most of the past year. A leap of over 400,000 is expected. The ISM Manufacturing PMI will also serve as a hint to the jobs report and may show elevated activity in America’s industrial sector.

Other noteworthy figures include housing figures, which will likely be upbeat, and the Conference Board’s Consumer Confidence gauge for March, which could be somewhat more subdued.

Here are the scheduled events in the US:

EUR/USD technical analysis

Euro/dollar has dropped below the 200-day Simple Moving Average – a clear bearish sign. The world’s most traded currency pair continues suffering from downside momentum on the Relative Strength Index (RSI) is still above 30 – outside oversold territory, at least for now.

Support waits at the 2021 trough of 1.1760, followed by 1.1690, which provided support in the autumn of 2020. Further down, critical support is situated at 1.1600, a double bottom. The next lines to watch are 1.1520 and 1.1430.

The early March low of 1.1836 turns to resistance. It is followed by 1.1875, which cushioned the pair later in the month, and then by 1.1950 and 1.2000 – the latter being a psychological barrier.

EUR/USD sentiment

Promises for a quick resolution to Europe’s virus crisis are unlikely to come in the upcoming week, while infrastructure hopes from Biden will likely boost the dollar. All in all, EUR/USD is set to remain under immense pressure.

The FXStreet Poll is pointing to an extended downfall in the short term and then an upswing later on. Experts have somewhat downgraded their average forecast but mostly for the upcoming week rather than further out.