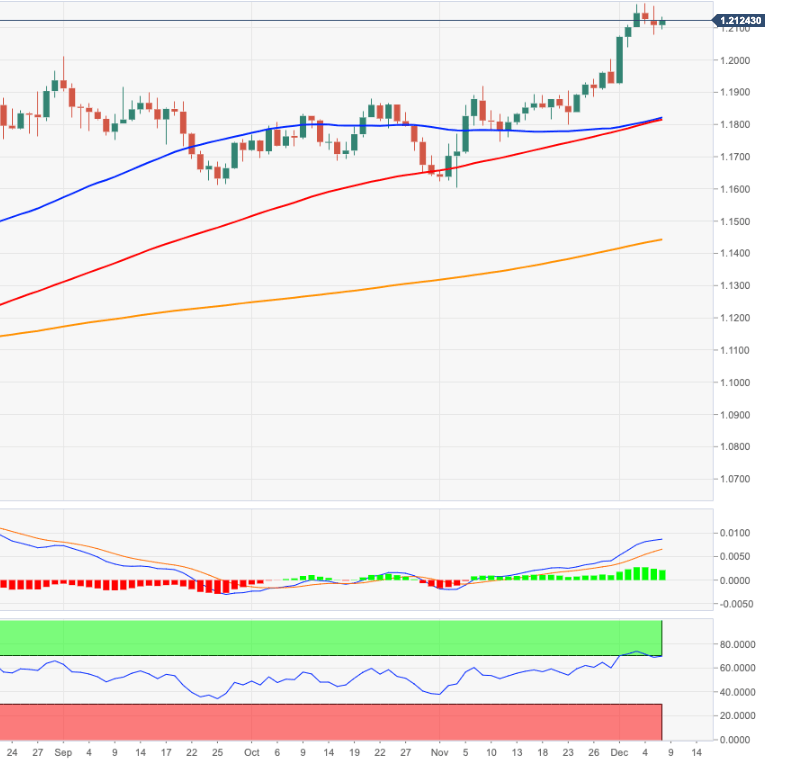

- EUR/USD regains the 1.21 mark after bottoming out near 1.2080.

- Overbought conditions still favour a correction in the near-term.

EUR/USD fades Monday’s pullback and reclaims the area above the 1.2100 barrier on Tuesday.

The positive stance in EUR/USD, however, remains unchanged and allows for the continuation of the uptrend in the near-term. However, the current overbought conditions open the door to a corrective downside in the next sessions.

In the meantime, a breakout of recent tops around 1.2180 should pave the way for a test of the 1.2200 yardstick. Further north aligns 1.2413 (April 2018 high) ahead of 1.2476 (March 2018 high).

Looking at the broader scenario, extra gains in EUR/USD are likely while above the critical 200-day SMA, today at 1.1442. The 200-week SMA near 1.1440 also reinforces this view.

EUR/USD daily chart