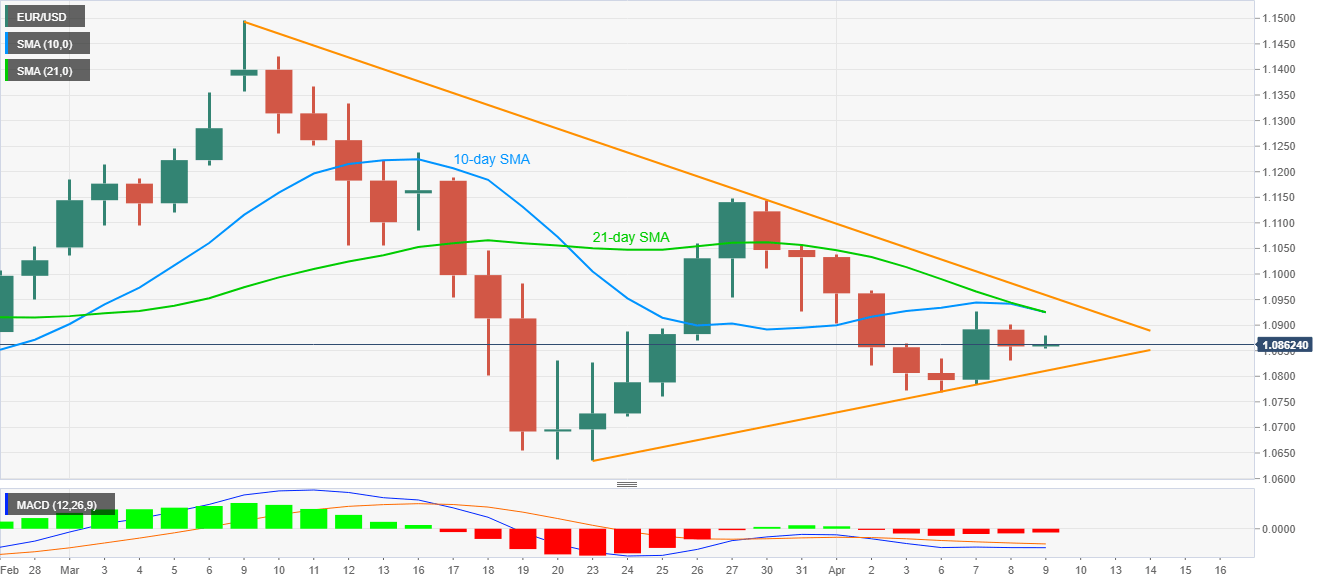

- EUR/USD fails to extend the previous losses below key short-term SMA confluence.

- Triangle formation signal near-term range, bearish MACD favor pullback moves.

Having stepped back from the near-term key SMAs, EUR/USD register mild gains to 1.0860 during Thursday’s Asian session.

In addition to the confluence of 10-day and 21-day SMA, near 1.0925, a downward sloping trend line from March 09, currently at 1.0960, also challenges the pair’s latest recovery moves.

In a case where the bulls dominate past-1.0960, late-March high near 1.1150 will be on their radars.

On the downside, a 13-day-old rising trend line near 1.0810 restricts the pair’s immediate declines ahead of the weekly low near 1.0770 and the previous month’s bottom surrounding 1.0635.

EUR/USD daily chart

Trend: Sideways