- EUR/USD refreshes intraday top while extending corrective pullback from two-week low.

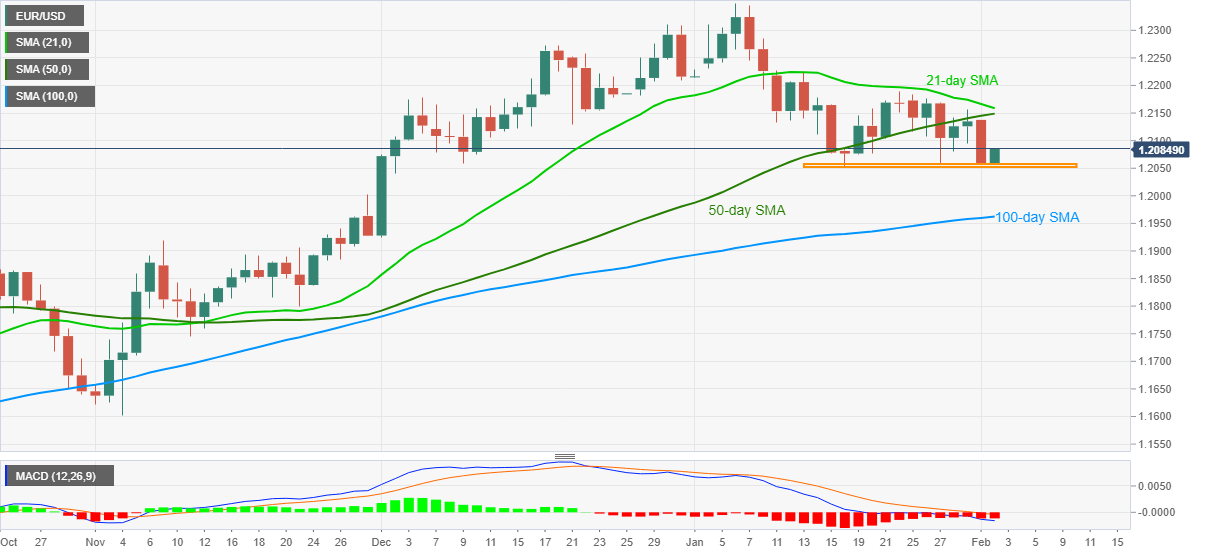

- Bearish MACD, sustained trading below the key SMAs favor the bears.

- 100-day SMA offers key support, buyers have a bumpy road even if they cross SMA hurdles.

EUR/USD rises to the intraday top of 1.2080, up 0.18% on a day, during early Tuesday. In doing so, the quote takes a U-turn from a horizontal area comprising lows marked since January 18.

However, bearish MACD signals and the pair’s sustained trading below 21-day and 50-day SMAs backs the EUR/USD sellers.

Even so, the latest recovery move may eye for the 1.2100 round-figure during further upside but the key SMA area near 1.2150-60 will be a tough nut to break for EUR/USD bulls.

Also acting as the upside barriers are the late January top around 1.2190, the 1.2270 and multi-month high flashed the last month, around 1.2350.

Meanwhile, a downside break of 1.2055 will direct the EUR/USD bears towards a 100-day SMA level of 1.1962. Though, the 1.2000 threshold can offer an intermediate halt during the fall.

It should be noted that the early November 2020 peak surrounding 1.1920 offers extra support to the south.

EUR/USD daily chart

Trend: Pullback expected