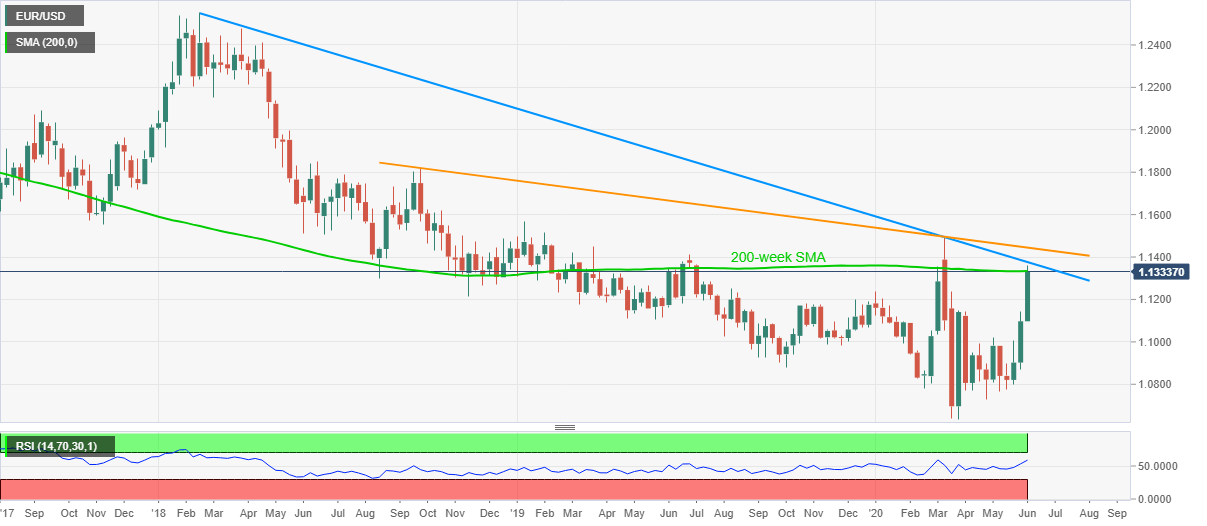

- EUR/USD seesaws near the highest in three months.

- 200-week SMA, a falling trend line from February 2018 guard immediate upside.

- January top can lure the sellers during a fresh pullback.

EUR/USD stays directionless around the multi-day top while taking rounds to the 1.1335 amid Friday’s Asian session.

The reason could be traced from the pair’s inability to cross 200-week SMA, currently around 1.1335.

Other than the key SMA, a downward sloping trend line from mid-February 2018, at 1.1375 now, also adds a filter to the pair’s north-run.

In a case where the bulls manage to cross 1.1375 on a weekly closing basis, a resistance line from September 2018, close to 1.1445/50, will be in the spotlight.

Meanwhile, the January month top near 1.1240 can act as near-term key support should the pair drops below 1.1300 adjacent rest-point.

EUR/USD weekly chart

Trend: Pullback expected