- EUR/USD extends Thursday’s sell-off as charts signal bearish conditions.

- The bulls need to clear 1.14 resistance to neutralize the negative setup.

EUR/USD is extending Thursday’s 0.64% decline, which was the biggest single-day percentage decline May 4.

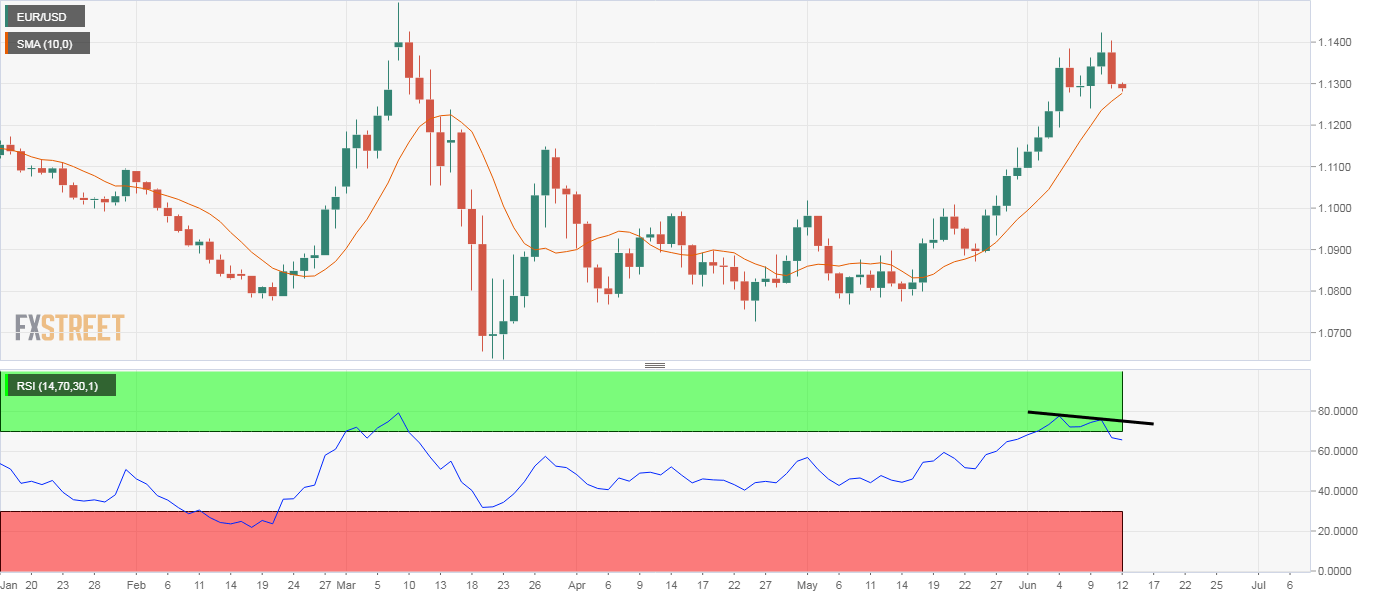

The pair is currently trading near 1.1285, representing a 0.13% decline on the day, and could soon test the ascending 10-day simple moving average (SMA) support at 1.1275, and may see a deeper drop, as technical charts are reporting bearish developments.

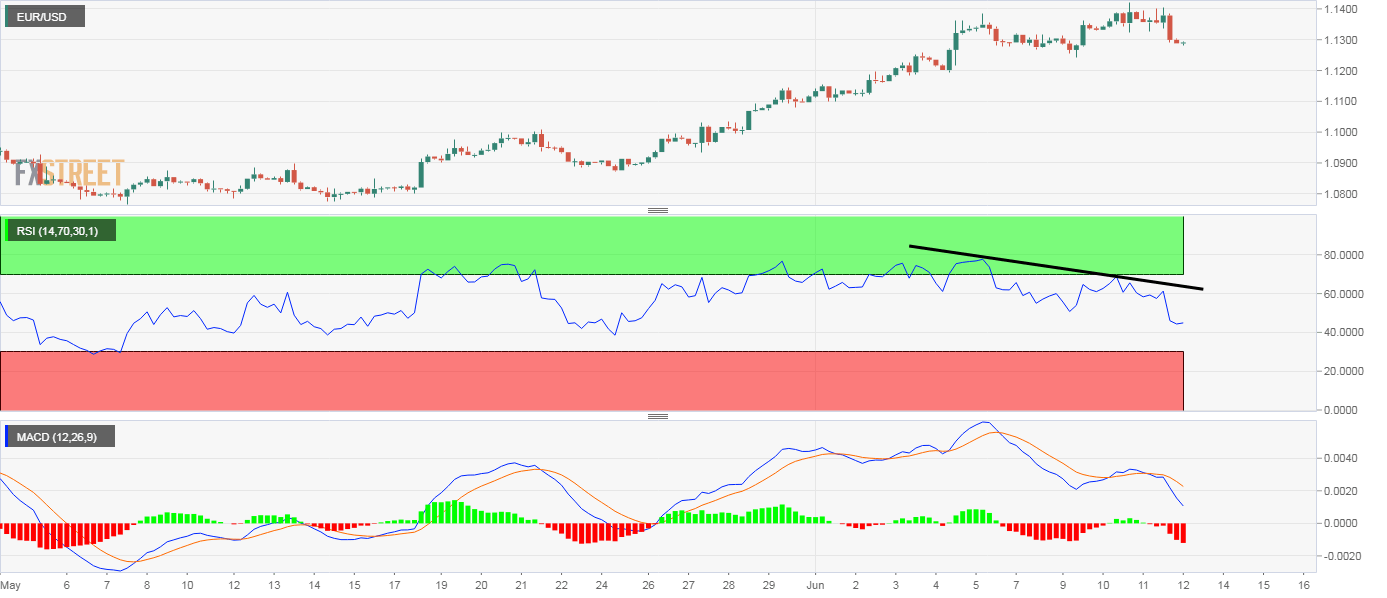

To start with the daily chart is reporting a bearish divergence of the relative strength index (RSI). A similar bearish divergence is seen on the 4-hour chart, which also shows the MACD histogram is reporting deeper bars below the zero line, a sign of the strengthening of downward momentum.

The negative outlook would be invalidated if the pair finds acceptance above 1.14.

Daily chart

4-hour chart

Trend: Bearish