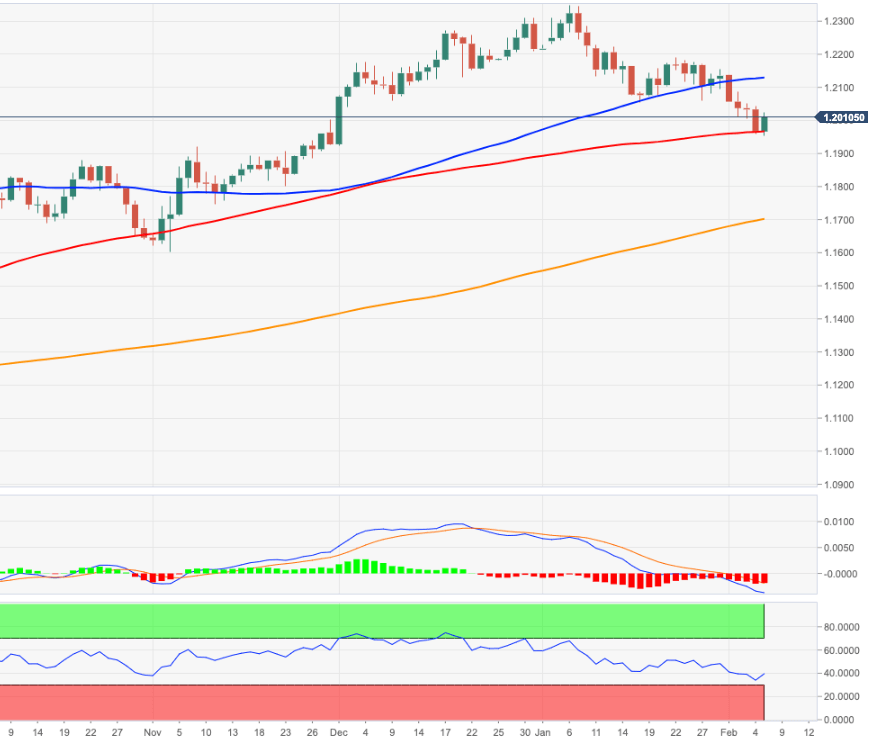

- EUR/USD bounces off 2021 lows in the mid-1.1900s.

- The next key level on the upside is now at 1.2189.

EUR/USD manages to reverse, albeit partially, the recent downside and rebounds from lows in the vicinity of 1.1950 on Friday, area last visited in early December 2020.

In case the recovery morphs into a more serious bullish attempt, EUR/USD is expecte to meet interim hurdle at 1.2064 (Fibo level of the November-January rally) followed by the 55-day SMA at 1.2115 and then another Fibo level at 1.2173. A surpass of the latter should expose the weekly highs near 1.2190 (January 22), above which the selling pressure is forecast to mitigate.

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1688.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.

EUR/USD daily chart