- EUR/USD drops as US-China tensions boost haven demand for the US dollar.

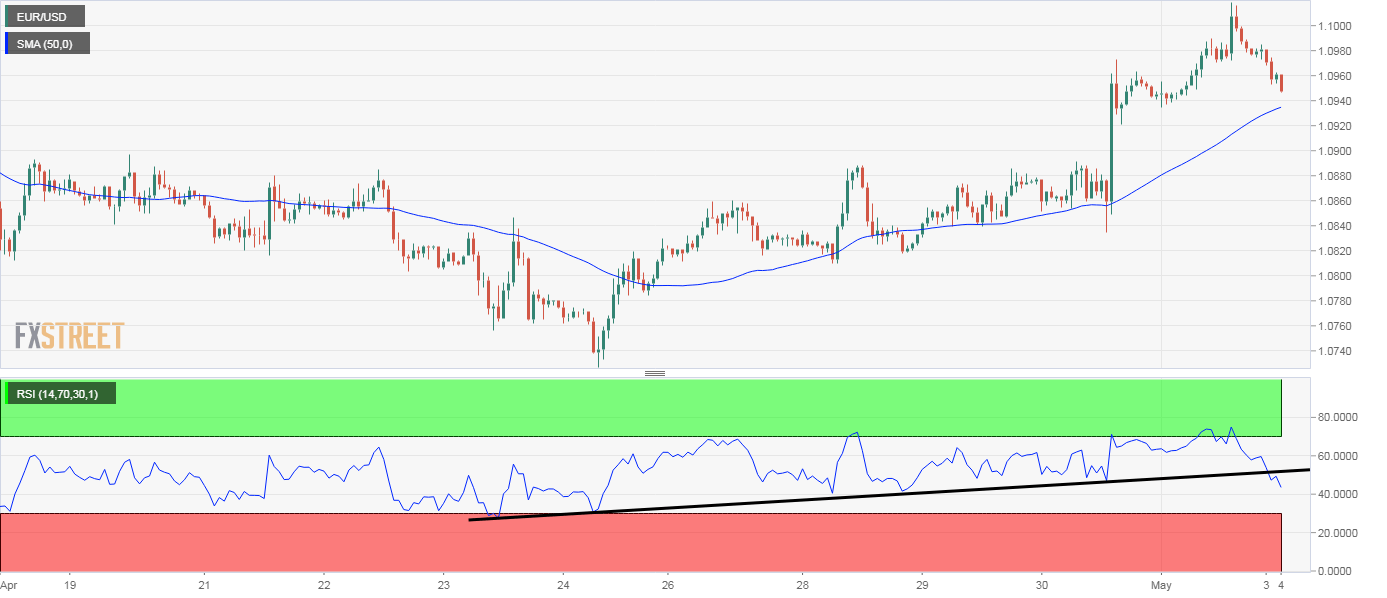

- The pair trades below the 50-day average amid bearish readings on intraday technical indicators.

EUR/USD is facing selling pressure alongside losses in the US stock futures and oil and is trading well below the 50-day average of 1.0964.

The risk has come under pressure during Monday’s Asian trading hours with the Trump administration accusing China of intentionally spreading the coronavirus.

The pair could suffer additional losses over the next few hours, as the hourly chart relative strength index has dived out of an ascending trendline, signaling an end of the pair’s bounce from the low of 1.0727.

Moreover, the risk aversion is likely to worsen with President Trump stating soon before press time that the US will end the trade deal reached in December last year if China does not buy the US goods.

EUR/USD could drop to the ascending 50-hour average support at 1.0935. Acceptance under that level would expose 1.09. The dip may be short-lived, as last week’s gain confirmed a bullish reversal pattern on the weekly chart.

That said, a close above the 200-day average at 1.1033 is needed to put the bulls into the driver’s seat.

Hourly chart

Trend: Pullback

Technical levels