- EUR/USD is ending the year on a strong note challenging the 1.1200 handle.

- The level to beat for bulls is the 1.1222 resistance.

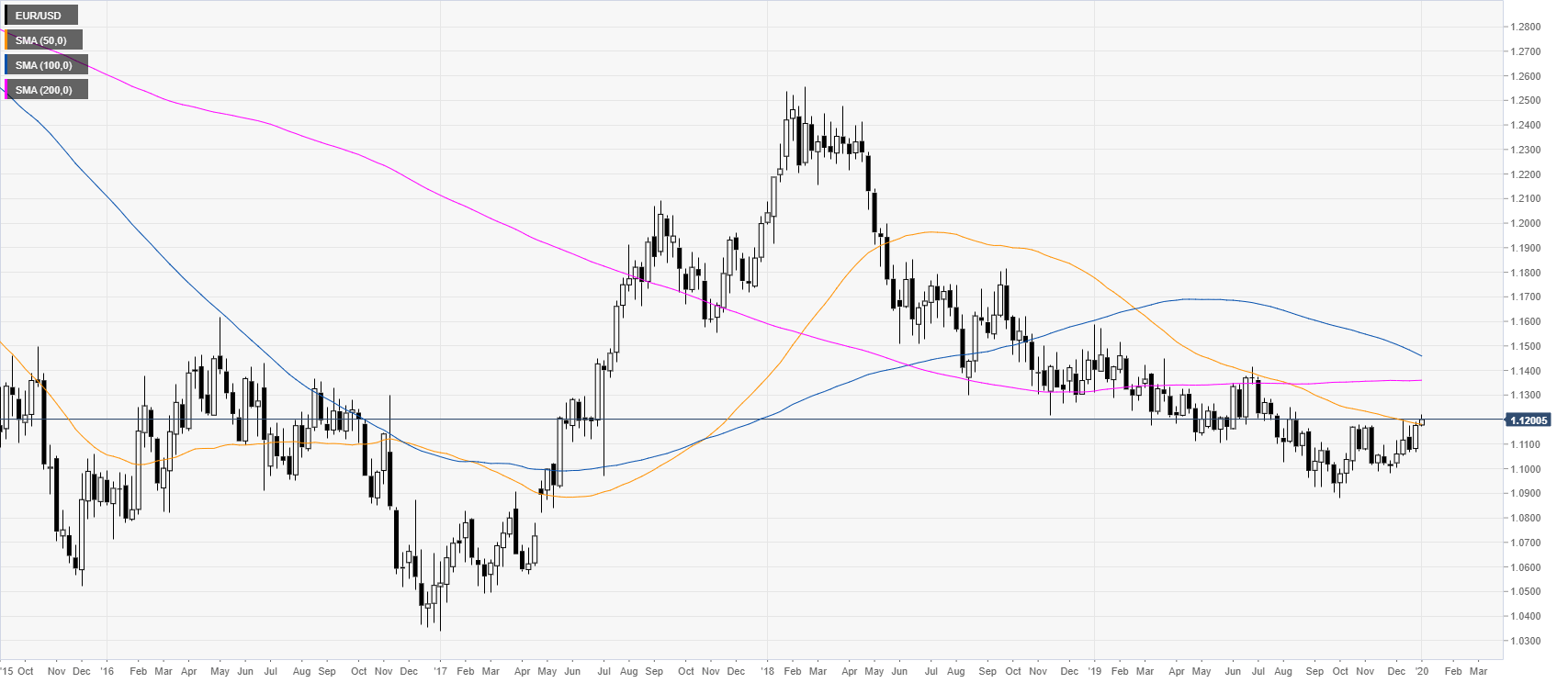

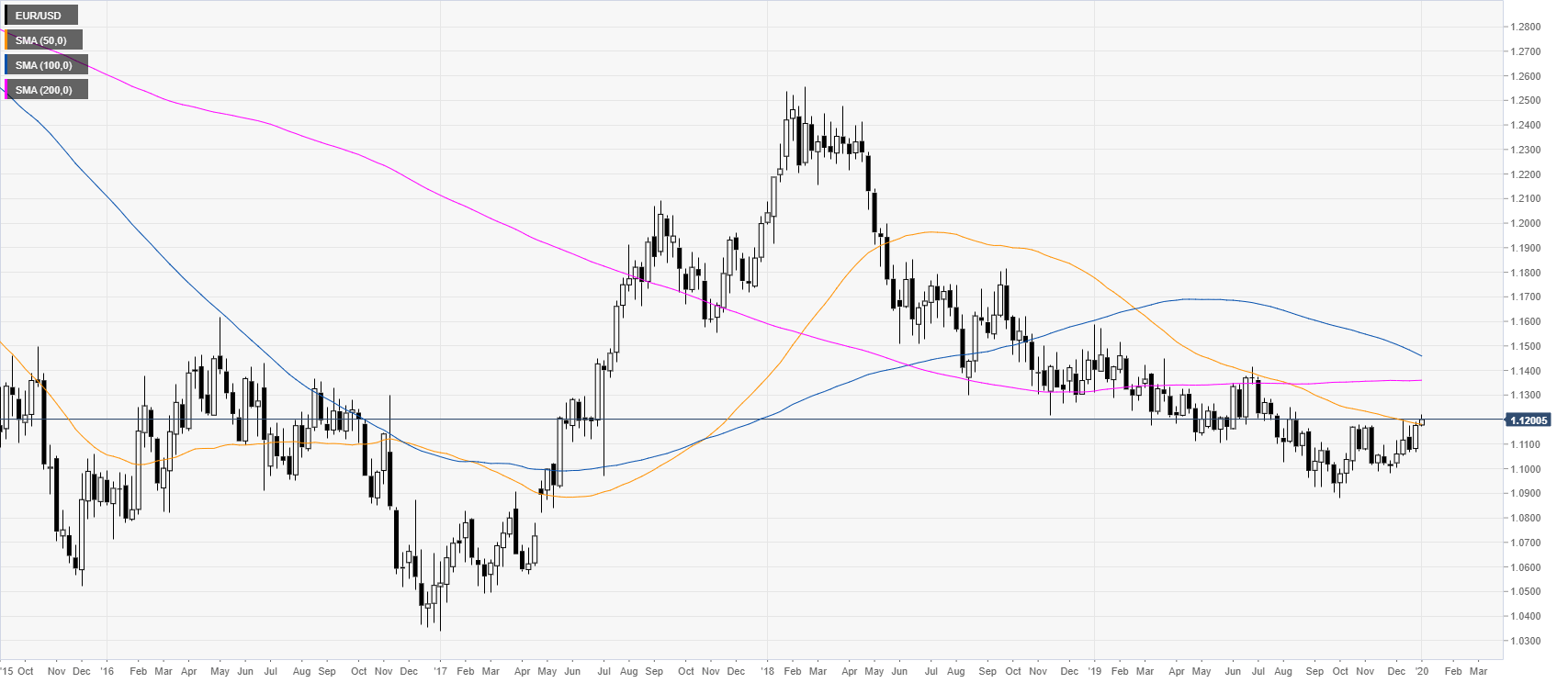

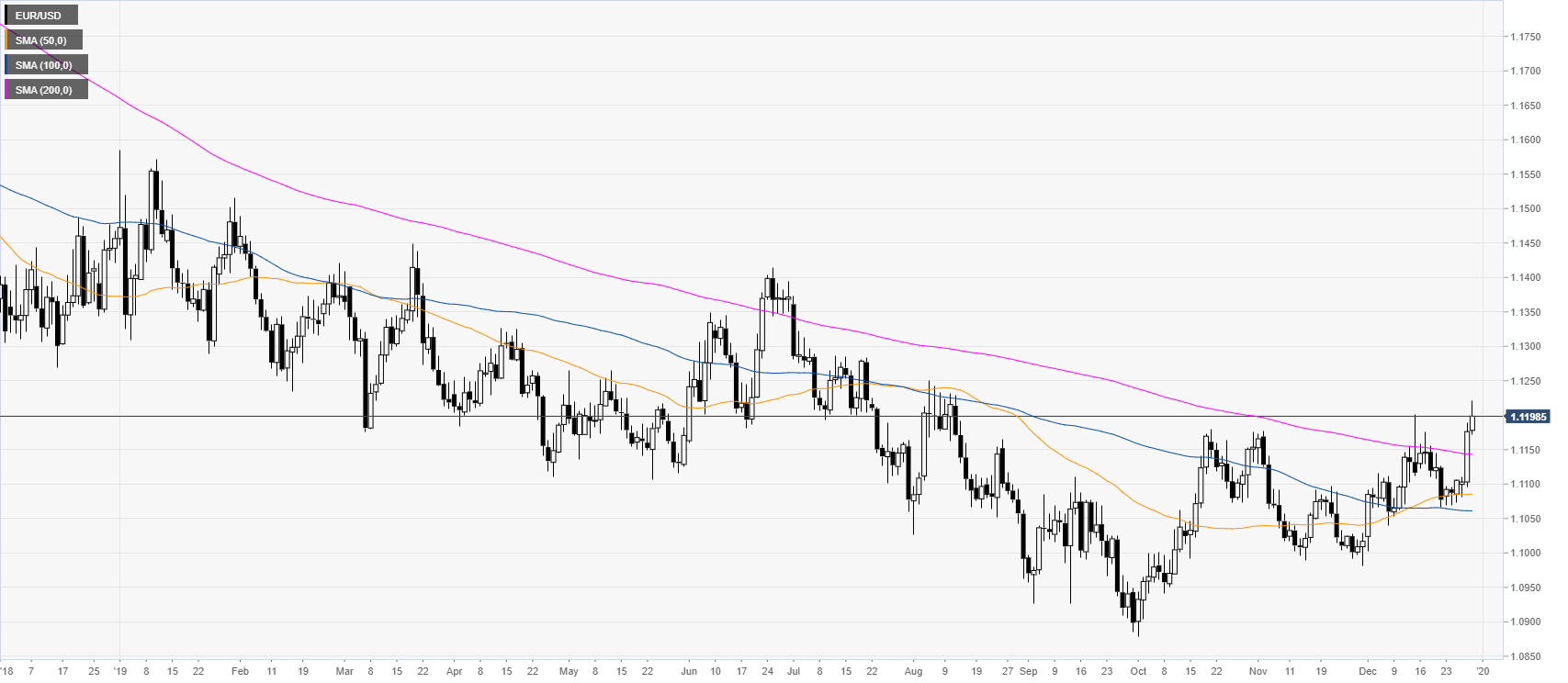

EUR/USD weekly chart

The euro is trading in a weak bear trend below the 100/200-period weekly simple moving averages (SMAs). However, the market is attempting to base above the 1.1000 handle. In the last quarter, the market has started to make higher highs and higher lows, but since the range is so small, the market remains essentially in a tight trading range. Neither side wants to commit and unless there is a strong fundamental catalyst, 2020 can be more of the same.

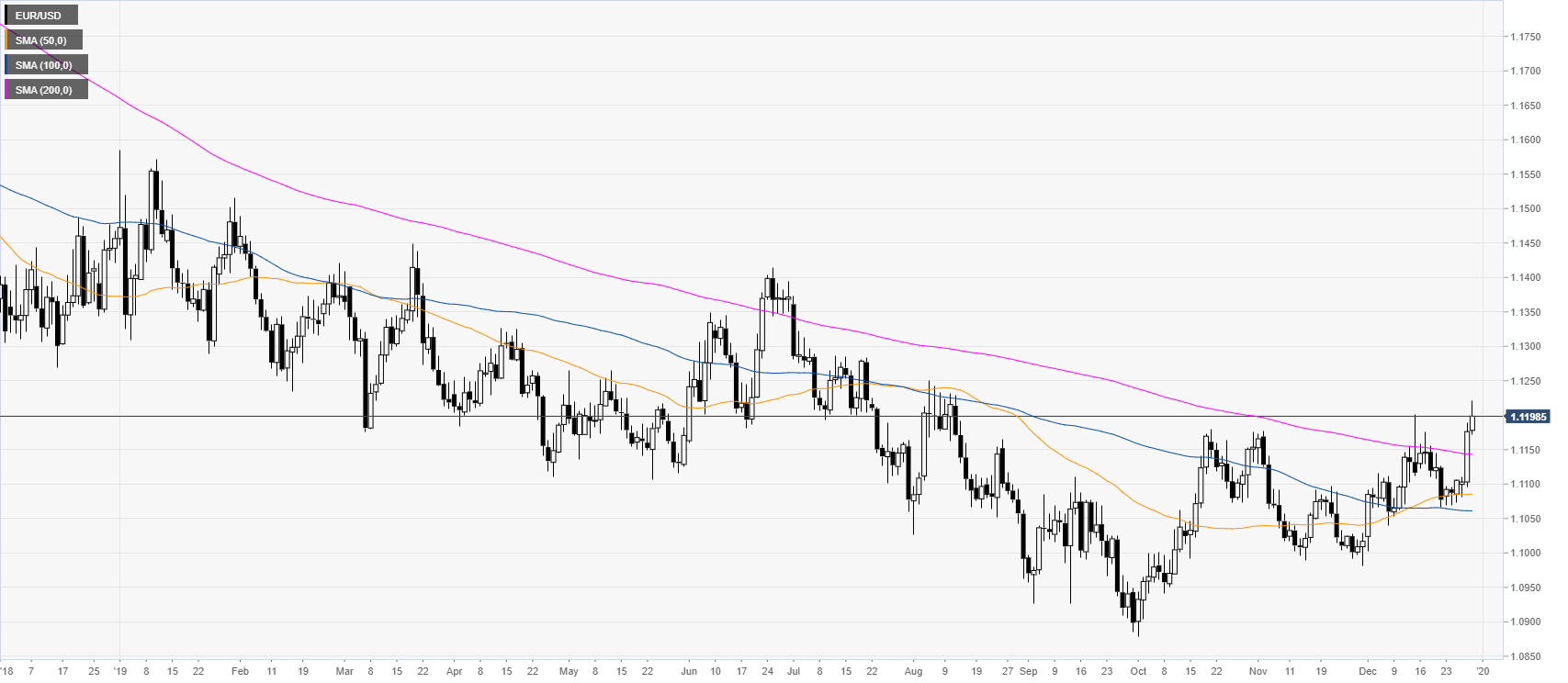

EUR/USD daily chart

Throughout 2019, EUR/USD has been drifting down, for the most part, below the 200-day SMA. However, the bear trend was often interrupted by sudden bullish attacks. The year 2020, might be another ranging year and given the lack of bearish enthusiasm in 2019, it seems unlikely that the market will enter a strong bear trend.

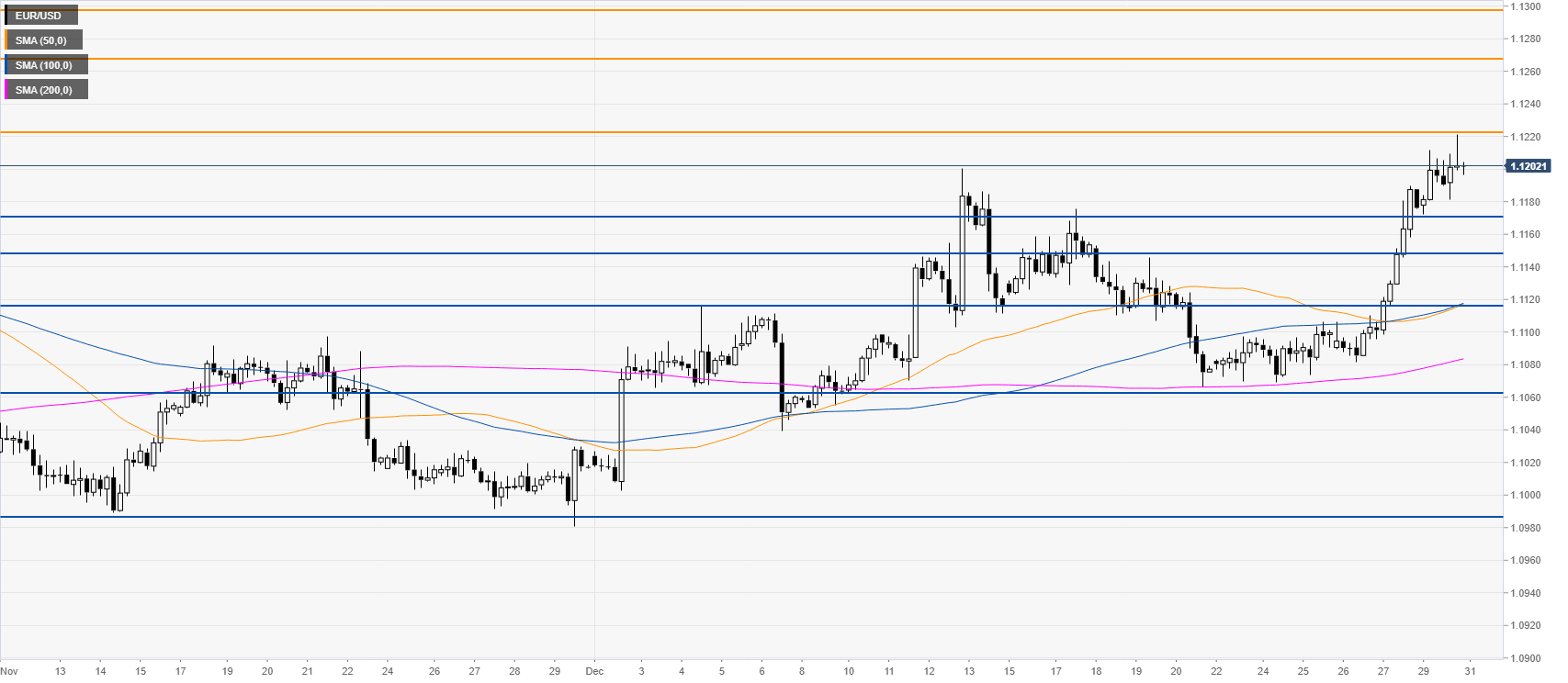

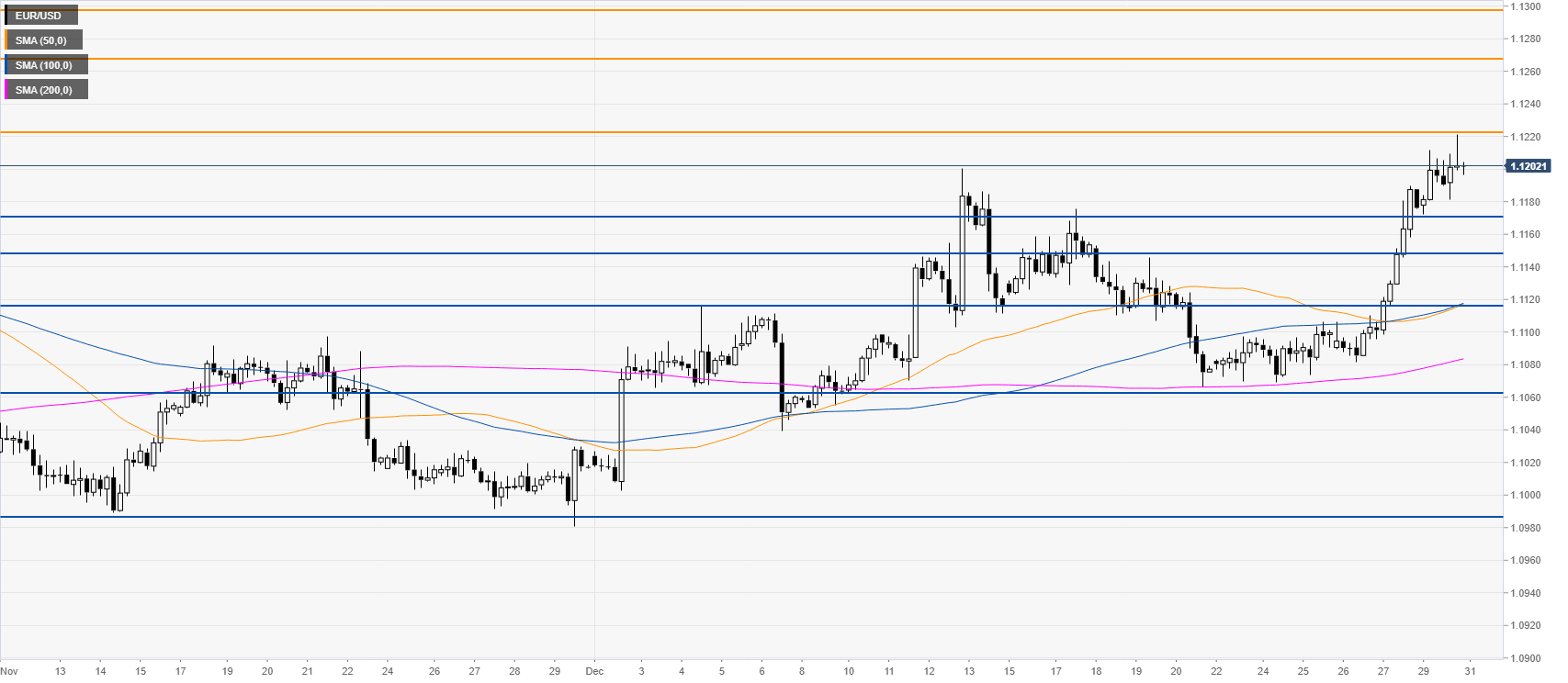

EUR/USD four-hour chart

The market is trading near five-month highs while pressuring the 1.1200 handle. The bulls took over while trading above the main SMAs. The buyers will likely try to break the 1.1222 resistance and try to reach the 1.1269, 1.1298 and 1.1333 levels. Support is seen at 1.1170, 1.1146 and 1.1117, according to the Technical Confluences Indicator.

Additional key levels