- EUR/USD slips to lowest since April 2017 during Friday’s Asian session.

- A bearish weekly close looks likely and could cause more sellers to join the market.

EUR/USD fell to 1.0653 a few minutes before press time, setting a new three-year low below Thursday’s low of 1.0655.

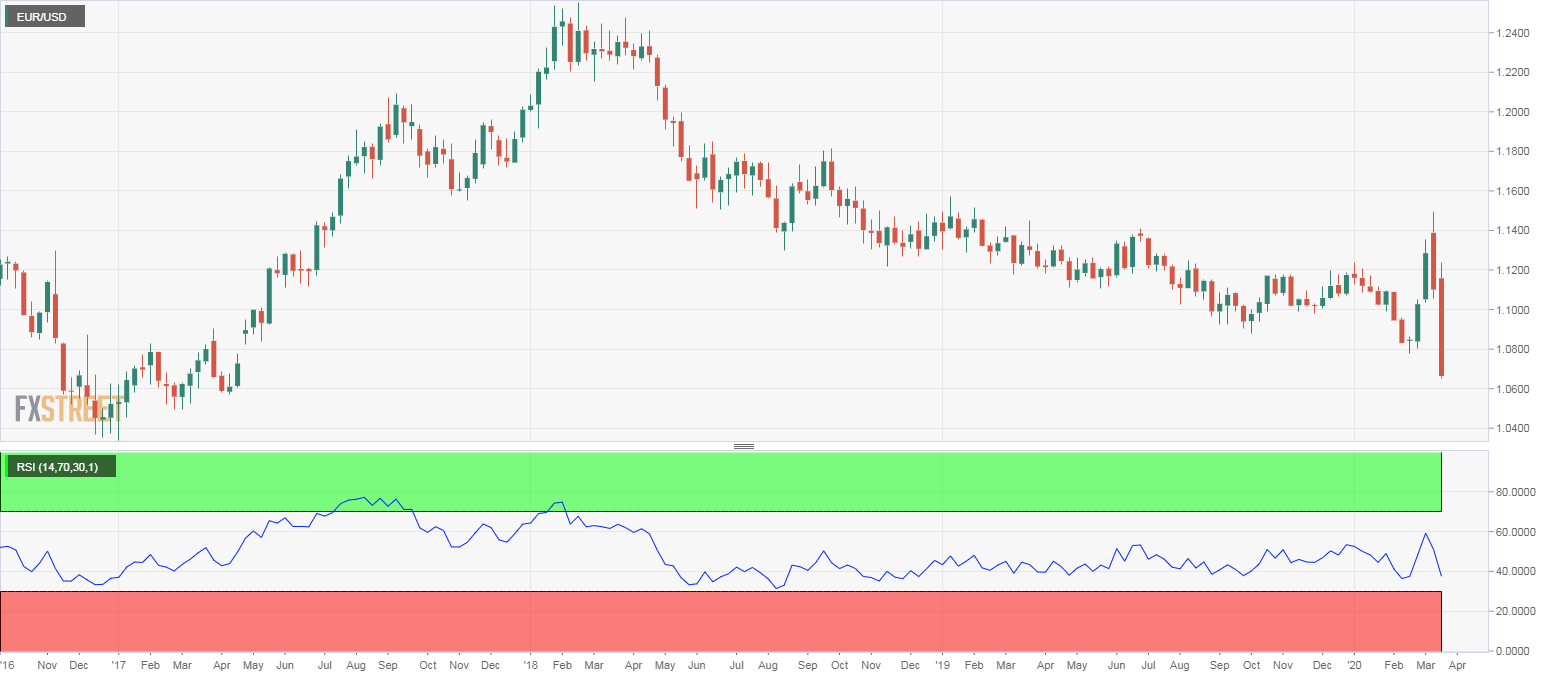

At press time, the hourly chart is reporting a bullish divergence of the relative strength index (RSI). So, a minor bounce may be seen from the current level of 1.0667.

The overall trend, however, looks bearish with the 5- and 10-day averages trending south and the weekly chart reporting a bearish crossover between the 100- and 200-week averages and a below-50 reading on the RSI.

The case for a slide to the December 2016 low of 1.0341 if the weekly candle ends (Friday’s close) below 1.0778 – the common currency had turned higher from that level in mid-February.

That looks like a done deal, given that the pair is currently trading at least 100 pips below 1.0778. Moreover, the EUR bulls could have a hard time engineering a recovery above 1.0778 as investors are worried that the Eurozone is set to plunge into recession due to the virus outbreak.

Weekly chart

Trend: Bearish