- EUR/USD’s daily chart show signs of bull fatigue.

- The pair risks falling to a former hurdle-turned-support.

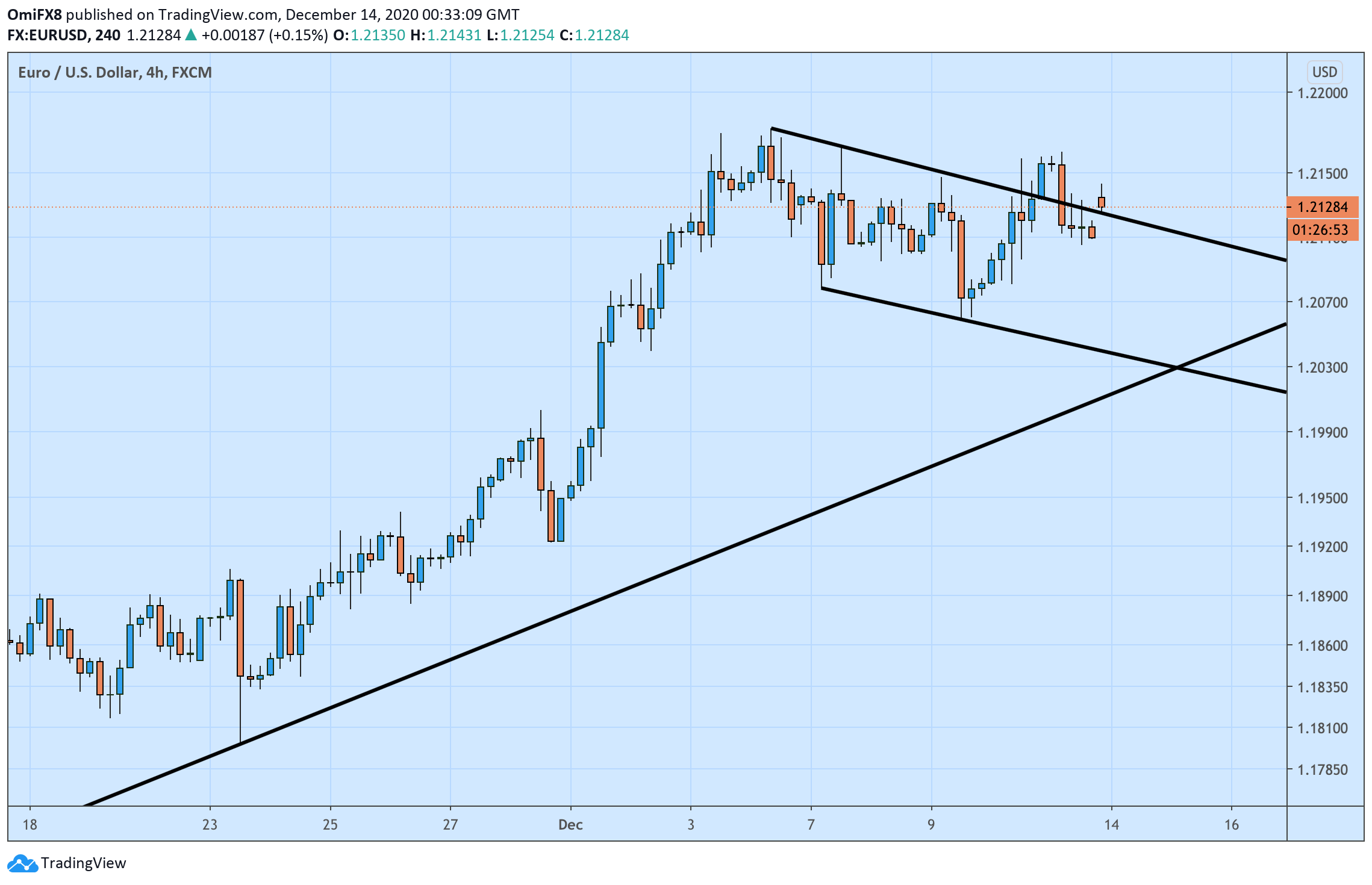

EUR/USD is trading around 1.2130 at the time of writing, having failed to keep gains above 1.2160 multiple times during the previous two weeks.

The pair had broken higher from the falling channel represented by trendlines connecting Dec. 4 and Dec. 7 highs and Dec. 9 and Dec. 11 lows last week, signaling a resumption of the rally from the Nov. 23 low of 1.18 and opening the doors to 1.22.

The breakout, however, was short-lived, as the pair fell back below 1.21 on Friday. A failed breakout is widely considered a powerful bearish signal. That, coupled with the uptrend exhaustion signaled by the long upper wicks attached to several daily candles, suggests a potential for a drop to the former hurdle-turned-support of 1.2014 (Sept. 1 high).

On the higher side, a convincing move above 1.2160 is needed to revive the immediate bullish view.

4-hour chart

Trend: Bearish

Technical levels