- EUR/USD pressured as DXY underpinned on rising T-yields.

- Bear pennant breakdown on the hourly chart points to more losses.

- All eyes remain on US payrolls and politics for fresh impulse.

EUR/USD is off the lows but remains under pressure near 1.2250, as the relentless rally in the Treasury yields buoys the US dollar ahead of the critical NFP release.

The US dollar retreated from session tops above 90.00 vs. its main peers on brief optimism sparked by encouraging news from Pfizer that its coronavirus vaccines appear effective against the new strains of the virus found in the UK and South Africa.

Despite the bounce in the major, the risks remain tilted to the downside, as the Treasury yields will likely rally on US stimulus hopes, lending support to the greenback.

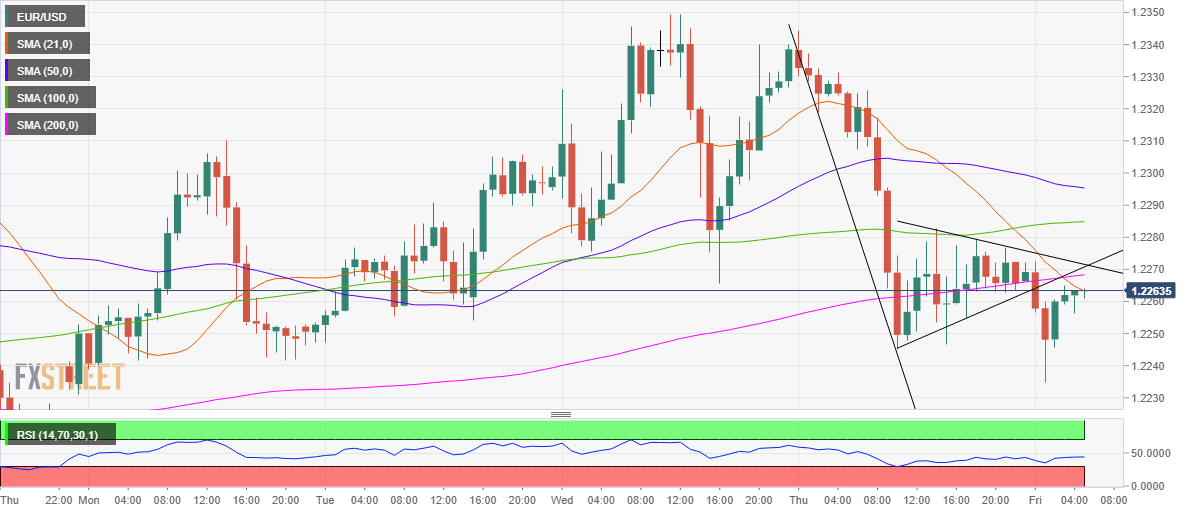

The hourly price chart also paints a bearish picture for the main currency pair, especially after the price confirmed a bear pennant breakdown early Friday.

Further, the bearish crossover, with the 21-hourly moving average (HMA) having pierced the 200-HMA from above, also adds credence to the downside bias. The hourly Relative Strength Index (RSI) trades flat below the midline, currently at 43.30, allowing room for more declines.

Therefore, the sellers could challenge the daily lows of 1.2235 on a fresh supply-wave, below which the 1.2200 level could be put at risk.

On the flip side, 200-HMA at 1.2268 could continue to offer stiff resistance. Acceptance above the latter could call for a test of the 1.2300 psychological magnate once again.

EUR/USD: Hourly chart

EUR/USD: Additional levels