- EUR/USD risks a corrective decline before it resumes its uptrend.

- Daily chart shows the price wavers in the overbought region.

- The 1.2000 level could offer buy the dips opportunity.

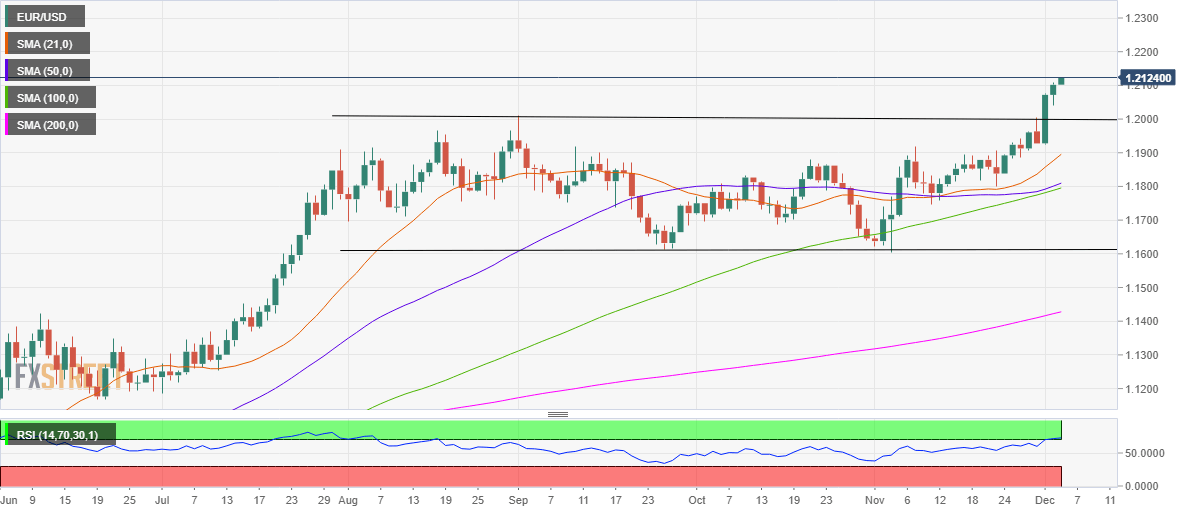

EUR/USD extends its bullish momentum into the third straight session, following a big breakout above 1.2000 witnessed last Tuesday.

The spot confirmed a five-month-long rectangle formation breakout on the daily chart, opening doors for a test of the measured target near the 1.2400 level.

The pair trades above all the major daily moving averages, suggesting that the path of least resistance is to the upside.

However, the bulls may need to catch a break before heading further north. This is reflective of the overbought conditions on the 14-day Relative Strength Index (RSI), which currently trades at 72.89 levels.

more to come …

EUR/USD: Daily chart

EUR/USD: Additional levels