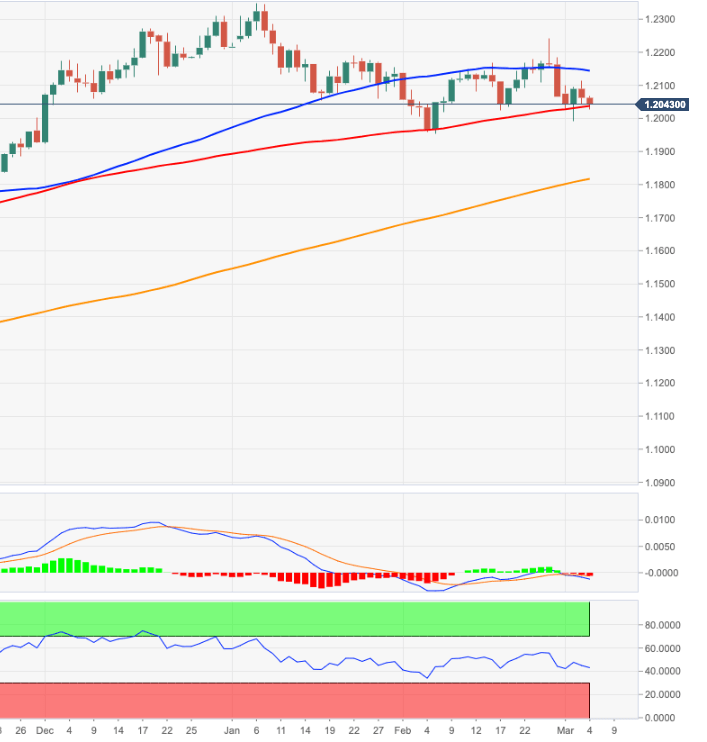

- EUR/USD extends the leg lower to the 1.2030/25 band.

- Further decline could see the 1.20 level challenged once again.

EUR/USD adds to Wednesday’s losses and flirt with the 100-day SMA near 1.2020.

Despite the ongoing weakness is seen as corrective only, it carries the potential to extend further and challenge the psychological 1.20 yardstick in the near-term. If cleared, a subsequent move to the YTD lows near 1.1950 (recorded in early February) should emerge on the horizon. Below this area, the selling pressure is expected to pick up pace and expose 1.1887 (Fibo level).

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1804.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.

EUR/USD daily chart