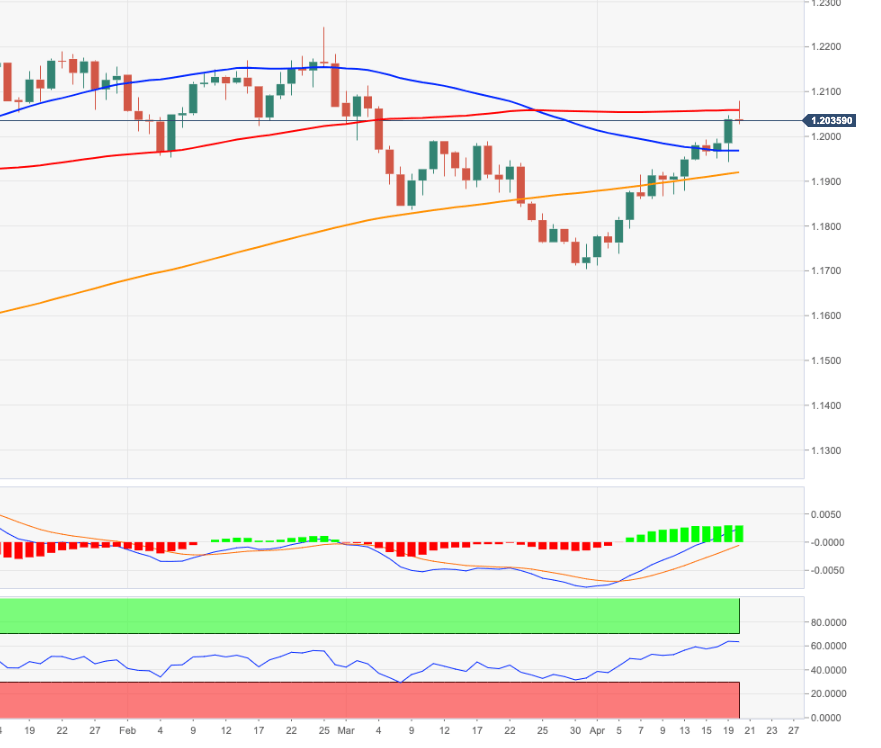

- EUR/USD’s rapid move past 1.2000 met resistance near 1.2080.

- Bouts of selling pressure are expected to be contained around 1.1910.

EUR/USD clinches fresh multi-week tops near 1.2080, although deflates to the negative ground afterwards.

The pair gained extra upside impulse after surpassing the 1.2050/64 band, where converge the 100-day SMA and a Fibo retracement (of the November-January rally).

Above the new peaks around 1.2080 comes in the interim hurdle at 1.2100 ahead of the February highs around 1.2240.

Above the 200-day SMA (1.1910) the stance for EUR/USD is predicted to remain positive.

EUR/USD daily chart