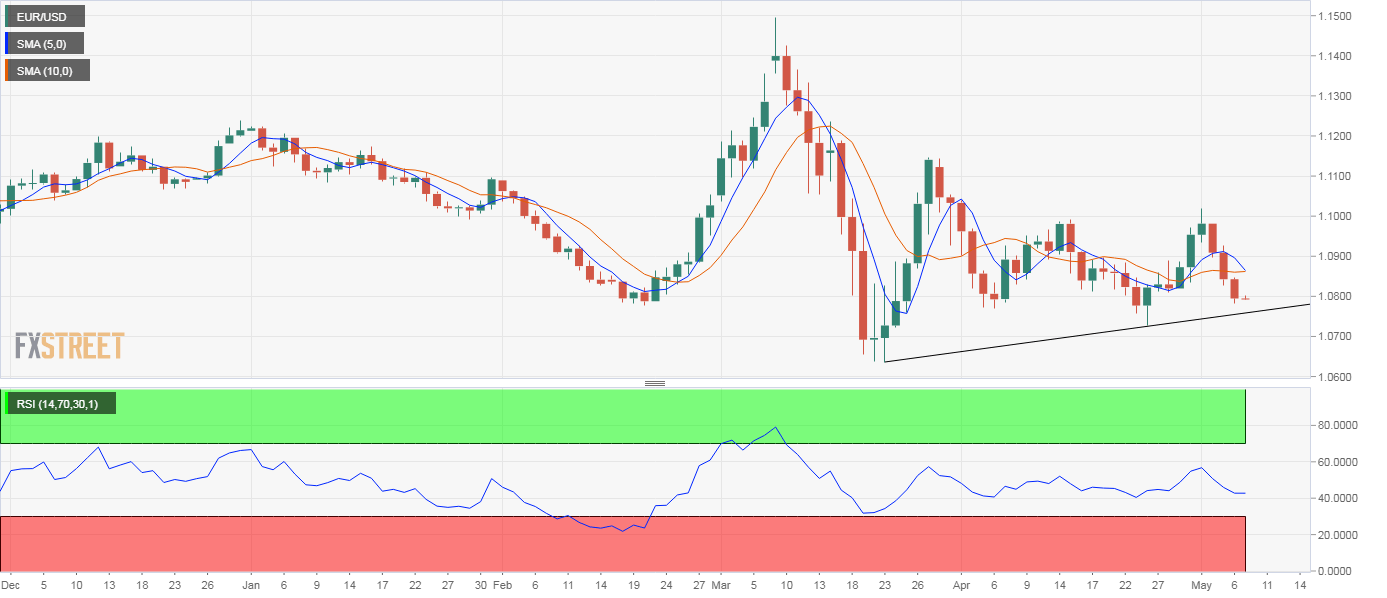

- EUR/USD’s three-day drop has put the focus on key trendline support.

- Short-term indicators are biased bearish and suggest scope for deeper retreat.

EUR/USD is hovering below 1.08 at press time, having dropped for the third straight day on Wednesday.

With the sharp reversal lower from the May 1 high of 1.1019, the pair has reversed more than 75% of the bounce from 1.0727 and exposed the support of the trendline connecting March 23 and April 24 lows. As of writing, that trendline support is located at 1.0762.

The 14-day relative strength index is reporting bearish conditions with a below-50 print and the 5- and 10-day averages look set to produce a bearish crossover. Hence, a drop to the trendline support looks likely. Acceptance lower will likely cause more chart-driven selling, leading to a deeper slide to 1.07 and possibly to 1.0636 (2020 low).

On the higher side, a close above 1.1019 is needed to confirm a bearish-to-bullish trend change.

Daily chart

Trend: Bearish

Technical levels