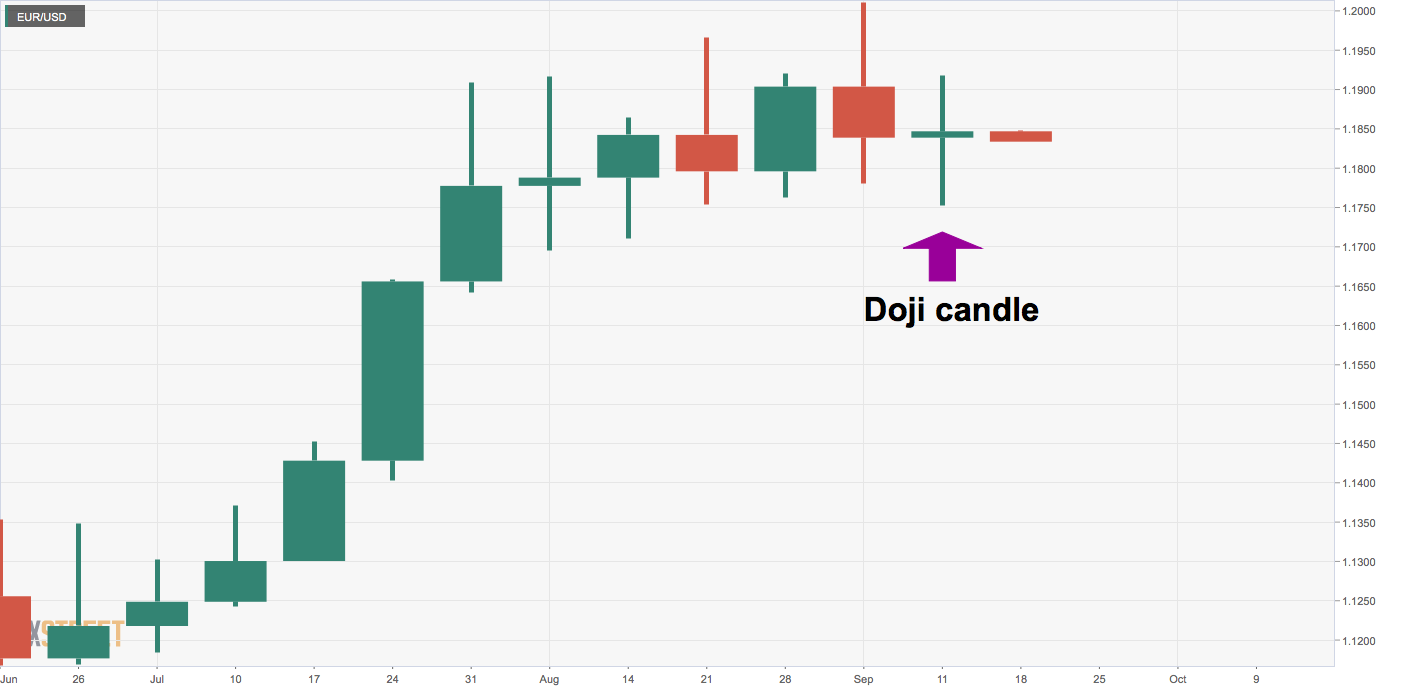

- EUR/USD saw two-way business and printed a Doji candle last week.

- The Doji candle’s low of 1.1753 is the level to defend for the bulls.

EUR/USD created a Doji candle last week as it swung both ways before printing a flat close.

The Doji indicates indecision in the market place. As such, the bias will remain neutral while the exchange rate is held within the Doji’s high and low of 1.1918 to 1.1753.

A move below 1.1753 would confirm a bearish Doji reversal pattern and open the doors for 1.1495 (March 9 high). Alternatively, a break above 1.1918 would signal a resumption of the broader uptrend and expose recent highs above 1.20.

At press time, the pair is trading mostly unchanged on the day at 1.1838.

Weekly chart

Trend: Neutral

Technical levels