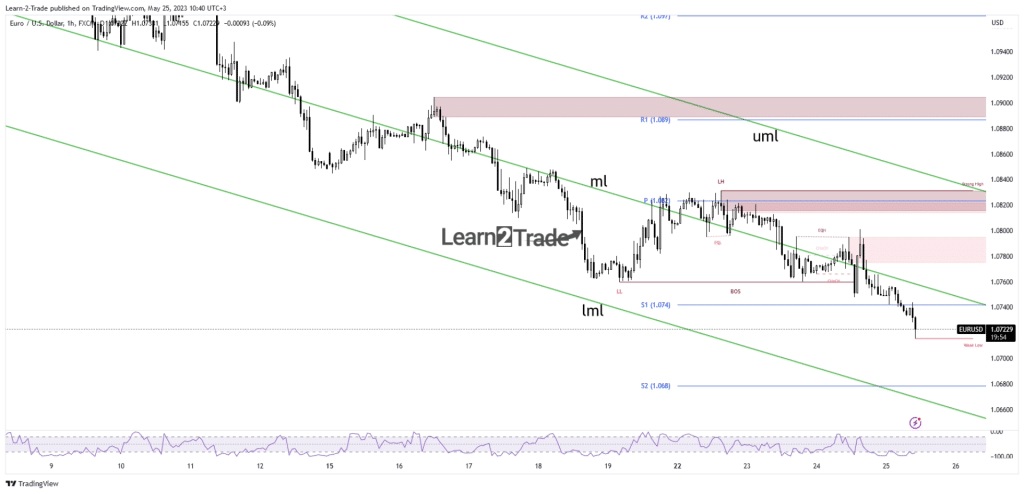

- As long as it stays below the median line, the currency pair could approach and reach new lows.

- The lower median line (LML) and the weekly S2 (1.0680) represent downside targets.

- The US economic data should bring some action later.

The EUR/USD price extended its downside movement, trading at 1.0721, far below yesterday’s high of 1.0801. The bias is bearish, so further losses are probable.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Yesterday, the Euro took a hit from the German Ifo Business Climate. The indicator was reported at 91.7 points versus 93.0 points estimated. The Greenback remains strongly bullish post the FOMC Meeting Minutes.

Today, the German Final GDP reported a 0.3% drop versus the 0.0% growth estimated and compared to the 0.0% growth in the previous reporting period, while German Gfk Consumer Climate came in at -24.2 points versus the -23.6 points forecasts.

Later, the US Prelim GDP may report a 1.1% growth after a 1.1% growth in the previous reporting period, while the Unemployment Claims indicator could be reported at 249K in the last week.

Furthermore, Prelim GDP Price Index and Pending Home Sales data will also be released. Tomorrow, Core PCE Price Index, Durable Goods Orders, Core Durable Goods Orders, Personal Income, Personal Spending, and Revised UoM Consumer Sentiment could move the rate.

EUR/USD price technical analysis: Bearish bias

Technically, the EUR/USD pair stabilized below the median line (ml) after making a false breakout with great separation above 1.0794 former high. It has validated the breakdown below the weekly S1 (1.0740) and seems determined to approach new lows.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

As long as it stays below the median line (ml), the rate could approach and reach the lower median line (LML) and the weekly S2 (1.0680).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.