- EUR/USD bears remain in control as Asian stocks fall.

- The Fed’s tightening hawkishness is mirrored in global markets, putting pressure on risk-sensitive currencies.

- The dollar’s further strength is expected to undermine the EUR/USD and push it into the 1.10-12 range.

The EUR/USD price tumbles to 1.1200 area, following a second straight day of losses. Fed’s policy statement overnight triggers strong buying in the greenback.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

The US dollar is strong in Asia as investors worry about the Federal Reserve’s plans to steadily escalate politics and tensions between Russia and Ukraine.

According to expectations, the Fed left interest rates unchanged, skipped quantitative easing until late March, and announced a likely rate hike in March. However, Chairman Powell’s tone was more hawkish than expected, causing US and dollar yields to fall, causing severe damage to the euro amid divergence between the two countries’ central banks.

The EUR/USD is currently trading at 1.1220, down about 0.15% from a high of 1.1243. MSCI’s broad indicator for regional markets outside of Japan fell to its lowest levels since early November 2020, accompanied by a decline in Asian equities. Australian stocks and the Hang Seng Index in Hong Kong fell 2%. The blue chips in China gained 0.2%. Japan’s Nikkei index fell 3.22%, reaching its lowest level since November 2020.

This year, along with the start of the QT, we expect four rate hikes of 25 basis points instead of three, TD Securities analysts said. “Our forecast for 2022 is a 25 basis point rise in March, QT starting in May, and then 25 basis point rate hikes in June, September, and December.”

“Powell did not dwell on the need for aggressive tightening. Against majors, this confirms our bias for further US dollar strength earlier this year. As a result, EURUSD is likely to enter a lower 1.10-12 range.”

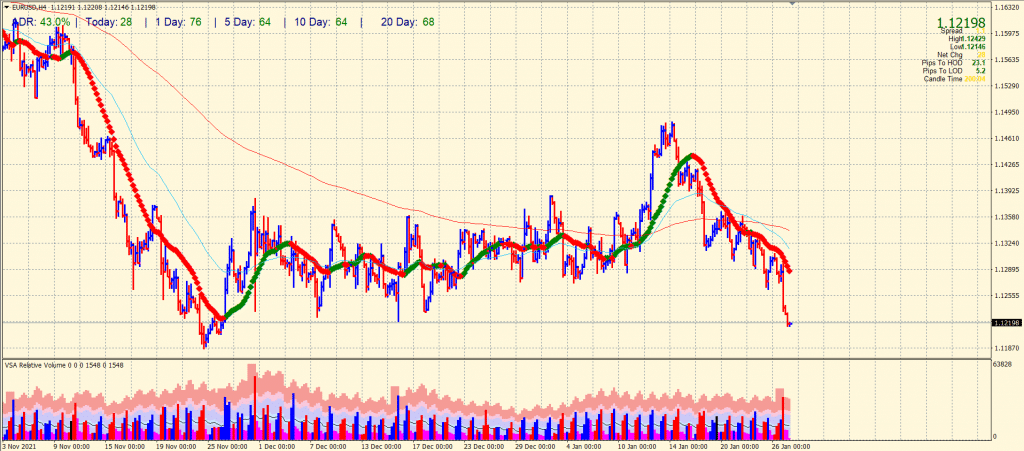

EUR/USD price technical analysis: Bears dominating

The EUR/USD price is eying to break the 1.1200 mark as the US dollar gains strength. Currently, the price is sitting at a 1.1220 support line. However, if the price breaks this support, we may see a test of Nov 25 lows at 1.1187.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Alternatively, we may see a pullback from here towards 1.1260 ahead of 1.1300. Meanwhile, the volume is strongly in favor of bears. The average daily range is 43%, indicating higher than normal volatility on the day.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.