- EUR/USD recedes further from earlier tops, around 1.1120.

- German IFO came in below expectations in August.

- US-China trade concerns keep ruling the markets’ mood.

The single currency keeps losing part of its shine at the beginning of the week and is now dragging EUR/USD to the area of daily lows in the 1.1120/15 band.

EUR/USD weaker on USD-buying, poor IFO

The pick up in the sentiment around the Greenback is driving spot lower on Monday and forcing it to give away part of Friday’s relevant advance. Trade concerns appear somewhat mitigated today in response to some tweets by President Trump, allowing the buck to regain some upside traction.

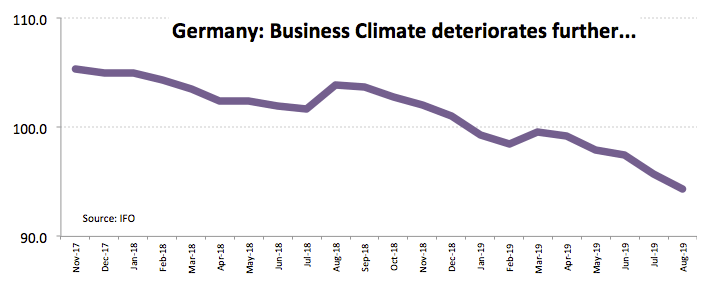

Also collaborating with the downside, the key German IFO indicator surprised to the downside once again, coming in short of expectations in all of its components for the current month and receding to multi-year lows. In fact, Business Climate dropped to 94.3 and Current Assessment and Business Expectations retreated to 97.3 and 91.3, respectively.

Later in the day, the focus will be on the US docket and the releases of Durable Goods Orders, the Chicago Fed Activity index and the Dallas Fed manufacturing gauge.

What to look for around EUR

The pair charted a bullish ‘outside day’ last Friday and today’s price action should be key in assessing the potential for further recovery in the next days. In the meantime, US-China trade jitters continue to drive the sentiment in the global markets, while expectations of ECB easing and Italian politics warns against the sustainability of occasional bullish attempts, all amidst the unremitting deterioration of the economic outlook in the region.

EUR/USD levels to watch

At the moment, the pair is retreating 0.19% at 1.1116 and faces immediate contention at 1.1113 (10-day SMA) followed by 1.1051 (low Aug.23) and finally 1.1026 (2019 low Aug.1). On the flip side, a break above 1.1186 (61.8% Fibo of the 2017-2018 up move) would target 1.1212 (55-day SMA) en route to 1.1282 (high Jul.19).