- The pair loses the grip and drops to 1.1640, daily lows.

- The greenback stays sidelined around 94.60 early in Europe.

- German IFO next of relevance in the euro area.

The renewed selling bias is now hovering over the single currency, forcing EUR/USD to recede to the area of 1.1650/40, or daily lows.

EUR/USD looks to data, sentiment

After two consecutive daily advances, the pair is now showing some signs of weakness and retreats to the 1.1650/40 band after climbing as high as the vicinity of 1.1680 last Friday.

On the opposite side, the greenback appears to have recovered the smile for the time being and is attempting a sideline theme in the 94.50/60 band when tracked by the US Dollar Index (DXY).

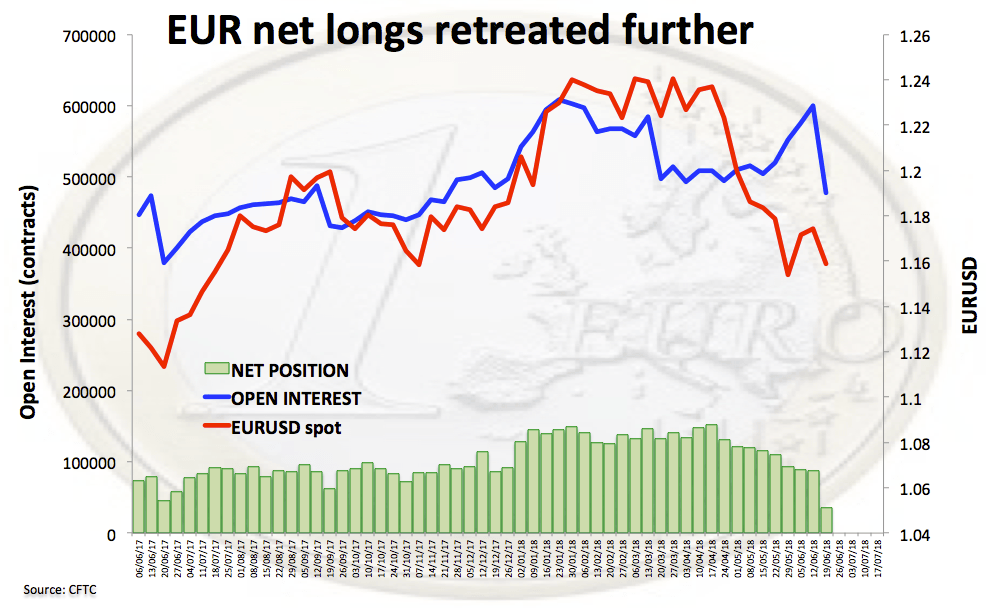

News from the speculative community noted EUR net longs receded to levels last seen in May 9 2017 on the week to June 19, according to the latest CFTC report.

Light calendar to start the week on the data front, with the German IFO for the current month being the salient event in Euroland later in the morning and US New Home Sales only expected across the pond.

EUR/USD levels to watch

At the moment, the pair is losing 0.10% at 1.1642 and a breakdown of 1.1509 (low Jun.21) would target 1.1508 (2018 low May 29) en route to 1.1479 (low Jul.20 2017). On the flip side, the next hurdle is located at 1.1672 (21-day sma) seconded by 1.1677 (high Jun.22) and finally 1.1718 (low Dec.12 2017).