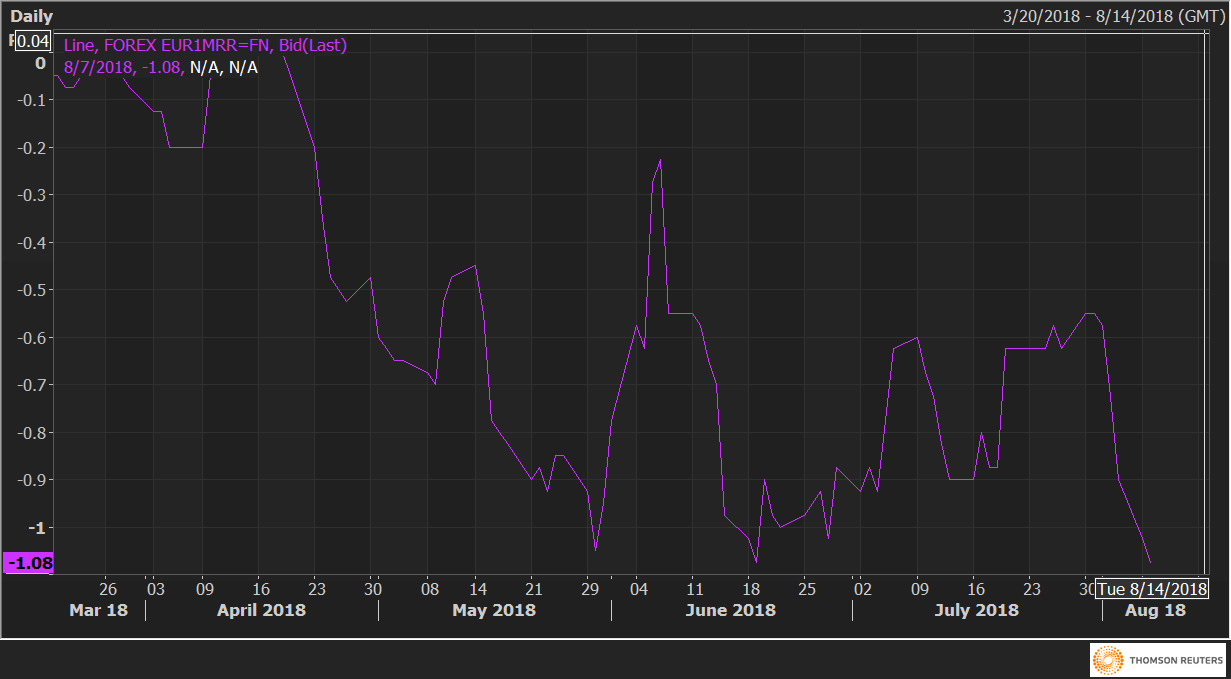

- EUR/USD risk reversals show a sharp rise in the implied volatility premium for the EUR put options (bearish bets).

- Focus on German industrial production and Italy-German yield spread.

The demand for the EUR put options has risen sharply in the last few days.

The one-month delta risk reversals (EUR1MRR) have dropped to -1.05 (the lowest level since June 19) vs -0.55 seen on July 31, indicating a pick-up in demand or implied volatility premium for the EUR puts (bearish bets).

The data add credence to the pennant breakdown seen on Thursday and suggests the investors are expecting a deeper drop in the spot.

The immediate support at 1.15 could be put to test today if the German industrial production prints below the forecast of a 0.5 percent month-on-month drop. The common currency could also take a beating if the fears of the Italian debt crisis push the 10-year Italy-German bond yield differential higher.

At press time, the EUR/USD pair is trading at 1.1555.

EUR1MRR

EUR/USD Technical Levels

Resistance: 1.1584 (10-day moving average), 1.1634 (10-day moving average), 1.1669 (50-day moving average).

Support: 1.1530 (previous day’s low), 1.1508 (June 21 low), 1.1463 (100-week moving average).