- The implied volatility premium for the EUR puts continues to rise despite the technical reversal in the EUR.

- A better-than-expected Eurozone consumer price index (CPI) could yield a stronger rebound in the EUR/USD pair.

Currently, the EUR/USD pair is trading at 1.1670 – up 1.4 percent from Tuesday’s low of 1.1510.

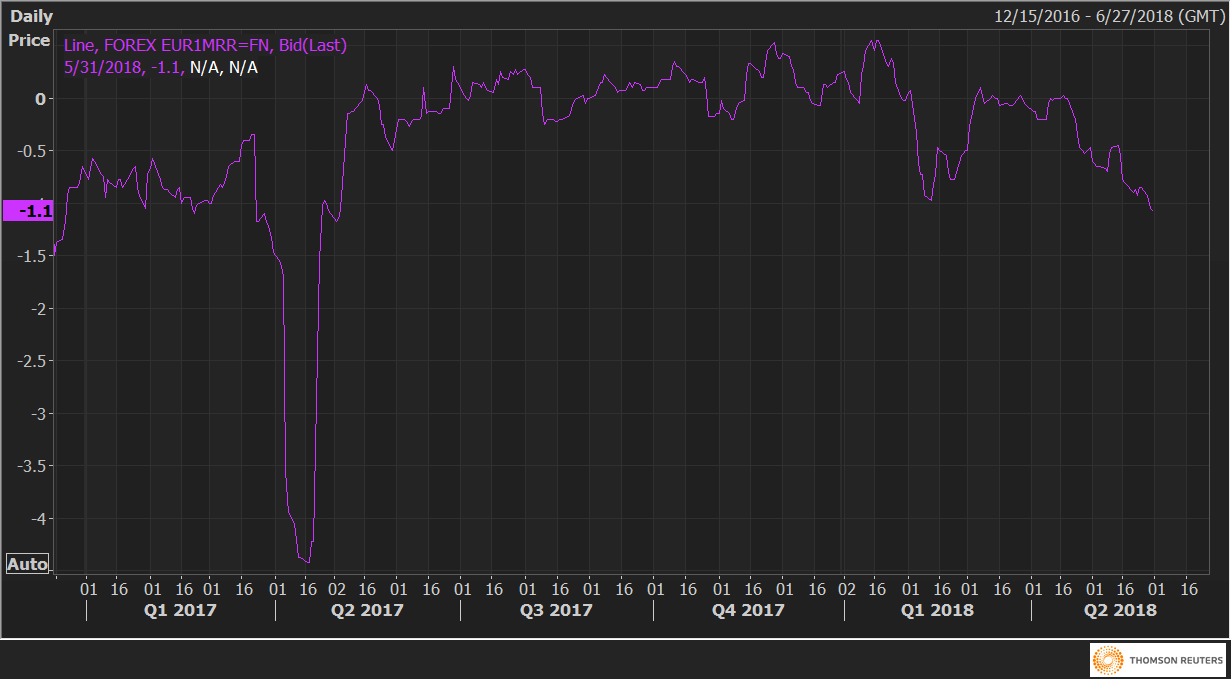

Despite the technical recovery, the options market remains bearish on the EUR. For instance, the EUR/USD one month 25 delta risk reversals (EUR1MRR) fell to -1.1 today – the lowest level since April 24, 2017, signaling a rise in implied volatility premium for the EUR puts.

In simple terms, it means the investors continue to buy the EUR puts (bearish bets) despite the corrective rally. It could be an indication the investors believe Italy is not out of the woods yet and also puts a question mark on the sustainability of the 1.4 percent rally in EUR/USD.

That said, the common currency could pick up a strong bid if the preliminary Eurozone May CPI, due today at 09:00 GMT, betters estimates.

EUR/USD Technical Levels

The resistance is seen at 1.1689 (10-day moving average), 1.1718 (Dec. 12 low), and 1.1780 (100-candle moving average on 4-hour chart). Meanwhile, support is lined up at 1.1648 (support on hourly chart), 1.1633 (100-hour moving average), and 1.1597 (50-hour moving average).

EUR1MRR