- EUR/USD is trading above 1.13 after surging and correcting some of its gains.

- Friday’s US jobs report and ECB President Lagarde’s speech are eyed.

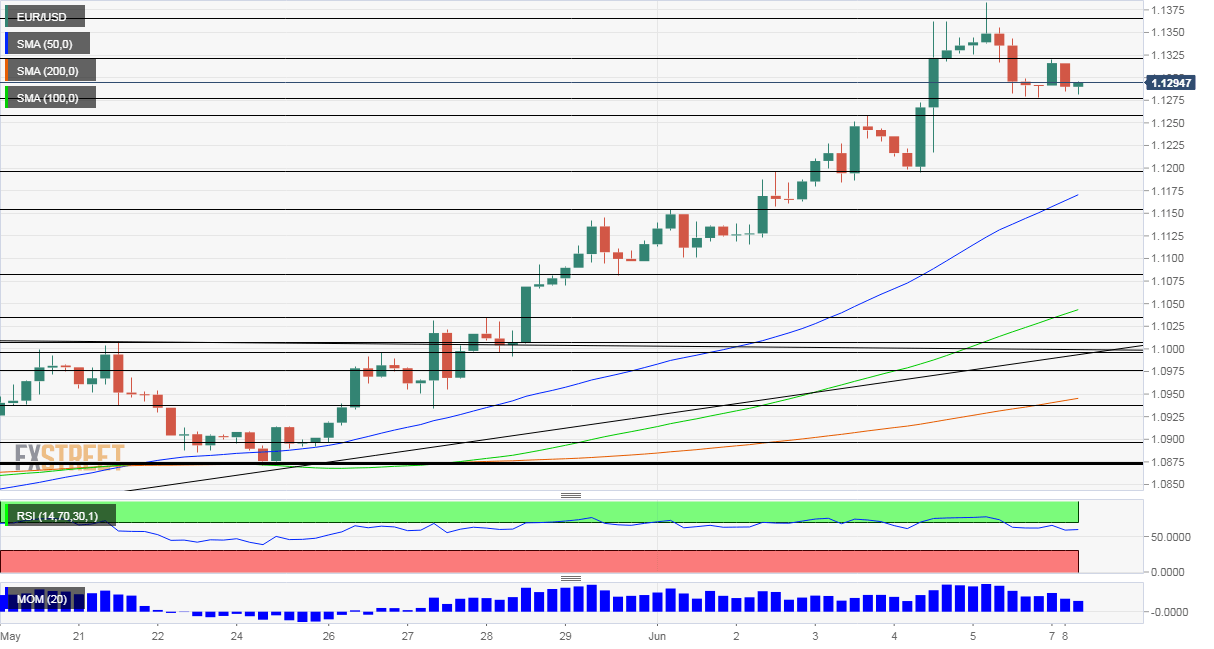

- Monday’s four-hour chart is showing the currency pair has exited overbought conditions.

Austerity is dead – and another reminder could send the euro higher once again. Christine Lagarde, President of the European Central Bank, is set to testify today and remind investors that both monetary and fiscal stimuli have been ramped up – to the delight of bulls.

Last Thursday, the ECB announced it is adding €600 billion to its Pandemic Emergency Purchase Program (PEPP) – its newest bond-buying scheme that has fewer limitations than previous ones. Moreover, the Frankfurt-based institution will reinvest the proceeds and maintain the scheme through at least June next year. The bank’s firepower lowers the government’s borrowing costs – Italian yields collapsed in response – and boost the economies.

Lagarde’s largesse came one day after Germany kicked off a €130 billion fiscal package, beating estimates and buying its conservative expenditure stance. The move by Europe’s largest country serves as an example to others. While the eurozone’s one-two punch remains modest in comparison to America’s multi-trillion action, it is a significant shift.

Lagarde’s testimony before the European Parliament will likely include calls for governments to do more to speed up the recovery from the crisis. The continent continues its gradual reopening with cases and deaths from coronavirus extending their decline.

Source: Financial Times

In America, investors continue digesting the surprisingly strong Non-Farm Payrolls figures – the US gained over 2.5 million jobs, a positive shock in comparison to expectations for a loss of millions of positions. The Unemployment Rate dropped to 13.3% with many low-earners returning to work – or at least receiving ample government support to keep them attached to employers.

The NFP data allowed the dollar a much-needed correction as it lessens the need for further monetary stimulus from the Federal Reserve, which announces its decision this week.

See:

- NFP Analysis: The complete labor market surprise

- NFP Analysis: Shocker surge in jobs may trigger a much-needed dollar bounce, regardless of stocks

It may also slow lawmakers’ gradual grind toward another fiscal stimulus package. Democrats want expenditure worth around $3 trillion while Republicans aim to settle for $1 trillion or less. Talks continue on Capitol Hill.

On the other hand, ongoing protests against racial discrimination may convince elected officials to move faster. Massive peaceful demonstrations were seen across the US, nearly two weeks after the killing of George Floyd, an unarmed black man, at the hands of the police. The events have yet to impact markets, but if they accelerate government spending, it would weigh on the safe-haven dollar.

Overall, Lagarde stands out on an otherwise quiet day, yet markets will likely ponder on developments from the recent past and future.

EUR/USD Technical Analysis

Euro/dollar exited overbought conditions – the Relative Strength Index on the four-hour cart dropped below 70 – allowing for further gains. Momentum remains to the upside and the world’s most popular currency pair continues trading above the 50, 100, and 200 Simple Moving Averages.

Resistance awaits at 1.1320, the daily high. Further up, 1.1365 was an initial peak, and it is followed by 1.1384, the highest since March. The next levels are 1.1410 and 1.1495.

Some support awaits at 1.1275. the daily low, and then by 1.1260, a temporary peak on the way up. The round 1.12 level served as a separator of ranges, and it is followed by 1.1150.