- EUR/USD has been inching its way higher ahead of critical events.

- Euro-zone growth and inflation figures are set to decline and the US Fed is set to cut rates.

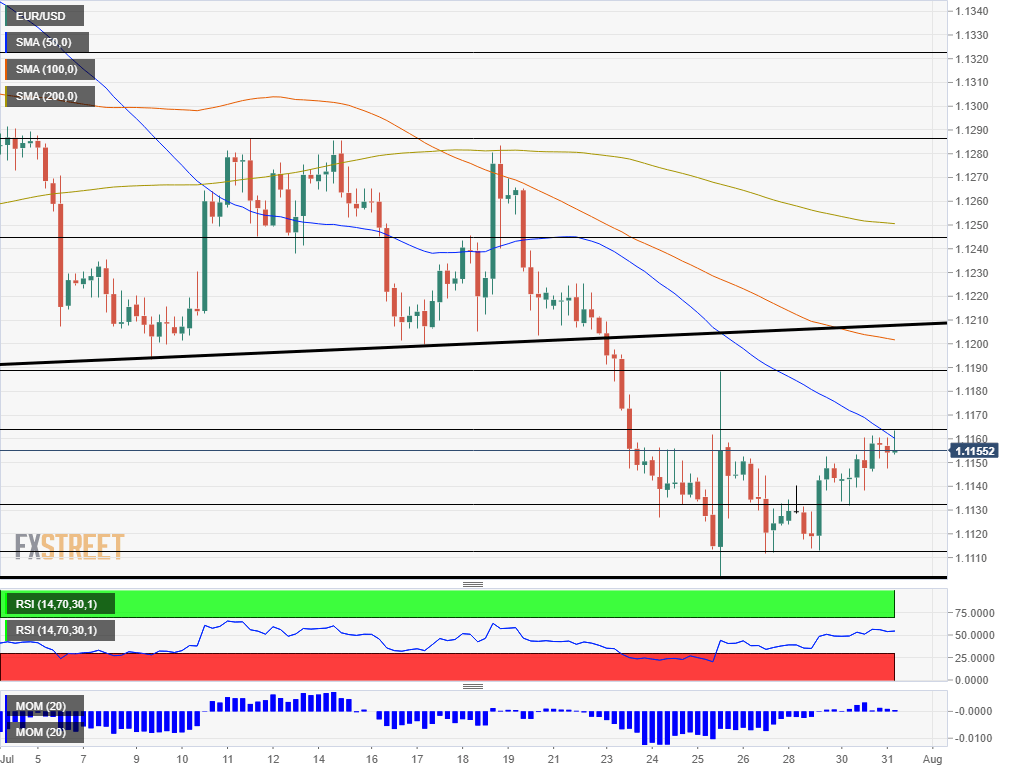

- Wednesday’s four-hour technical chart is mixed for EUR/USD.

EUR/USD has been enjoying its time out of the spotlight – but this is about to end shortly. Will the world’s most popular currency pair resume its falls? As central bankers say – it is data-dependent.

The British pound’s massive sell-off has been stealing the show but after now seems more stable, allowing euro-zone data to stand out and shift attention back to EUR/USD.

Preliminary inflation figures for July are set to reveal a slowdown in both headline Consumer Price Index (CPI) and Core CPI. German, French, and Spanish figures – already out on Tuesday and today – have not altered projections. Both figures are set to hover around 1% – far from the European Central Bank’s target of 2%.

Gross Domestic Product growth numbers may weigh more heavily. The economic calendar shows investors expect 0.2% in the second quarter – half the pace in the first one. However, preliminary readings from France and Spain indicate that the previous quarter’s expansion may disappoint these modest expectations.

See Euro-zone GDP and inflation preview: Depressing data may undermine EUR/USD ahead of the Fed

All eyes on the Fed

On the other side of the Atlantic, US data carries higher expectations. The ADP Non-Farm Payrolls report for private-sector jobs is set to show an increase of 150K positions in July – significantly above 102K reported in June. The figures shape expectations for the official employment report due on Friday.

The reaction to the ADP report may be relatively subdued as markets are gearing up to the main event of the week – the first interest rate cut by the Fed in over a decade. Fed Chair Jerome Powell and his colleagues have been readying a reduction in response to slow inflation and high uncertainty due to trade tensions. A cut of 25 basis points is priced into the dollar, and investors are already eying the next moves.

The base case scenario is for the Fed to signals that the move is only an “insurance cut” – a single event and not the beginning of a cycle that will see further cuts. In this case, the dollar has room to rise.

See Fed Preview: The currencies to trade in each of these four scenarios

The assumption is based on upbeat data. The labor market is robust, second-quarter growth is solid, and consumer confidence is reaching new highs. The latest consumer sentiment number for the Conference Board has smashed all expectations with a score of 135.7 points.

However, if the bank opens the door to further monetary stimulus, the greenback may struggle.

See Federal Reserve Preview: Is this a rate cycle?

All in all, the slow grind in EUR/USD is set to make way for high volatility.

EUR/USD Technical Analysis

EUR/USD has been challenging the 50 Simple Moving Average on the four-hour chart and is trading marginally above it at the time of writing. Momentum is weak but points to the upside while the Relative Strength Index is stable.

The current situation can be described as “cautiously optimistic.”

Initial resistance awaits at 1.1165 which is the daily high. It is followed by 1.1190 which was a swing high last week, and then by 1.1245 which served as both resistance and support early in July. 1.1285 is the next line to watch.

Support awaits at 1.1130, which provided support on Tuesday, and then by Monday’s low of 1.1110. The 2019 low of 1.1101 is critical support. Further down, 1.1025 and 1.0900 are next.