- The pair moves to session highs near the 1.1700 handle.

- Risk-on trade persists as markets digest Friday’s Payrolls.

- Sentix index next of relevance in the euro area.

EUR/USD is reverting Friday’s pullback, bouncing off lows near 1.1620 but with gains so far capped by the boundaries of 1.1700 the figure.

EUR/USD looks to Italy, data

The pair seems to be attempting a consolidative theme in the top end of the recent range near the 1.1700 handle amidst a better tone in the risk-associated complex and while market participants continue to adjust to the latest US Payrolls figures (223K).

However, further strength in the shared currency should need a clearer political scenario in Italy, which continue to gyrate around the populist coalition and its fiscal plans as well as the omnipresent likelihood of new elections.

The greenback, instead, has started the week on a weak note, easing to the 94.00 neighbourhood when tracked by the US Dollar Index (DXY) despite yields of the US 10-year note are trading on a firm fashion beyond 2.91%.

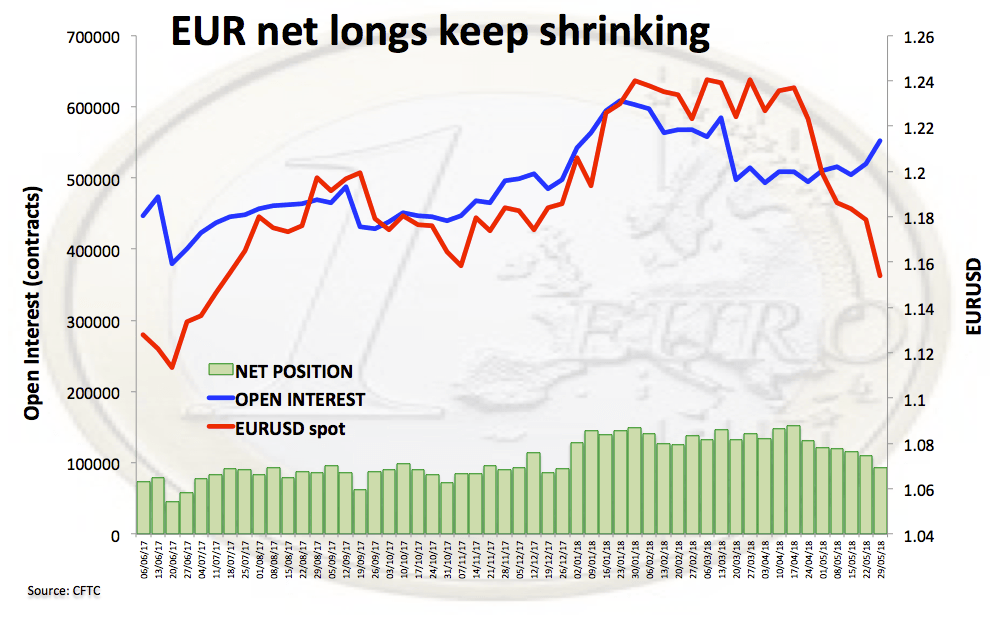

On the positioning front and following the latest CFTC report, EUR speculative net longs continue to retreat during the week ended on May 29, this time to levels last seen in late December 2017.

Data wise today, the Sentix index is due in Euroland along with Producer Prices for the month of April. Across the pond, April’s Durable Goods Orders and Factory Orders are also expected.

EUR/USD levels to watch

At the moment, the pair is gaining 0.21% at 1.1684 facing the immediate up barrier at 1.1726 (high May 31) seconded by 1.1769 (21-day sma) en route to 1.1830 (high May 22). On the flip side, a breakdown of 1.1617 (low Jun.1) would target 1.1511 (2018 low May 29) en route to 1.1479 (low Jul.20 2017).