- EUR/USD extends gains to the area above 1.1300.

- EMU, German flash PMIs surprised to the upside in June.

- Attention shifts to fresh coronavirus outbreaks in Germany.

The optimism around the single currency remains unbated so far in the first half of the week, with EUR/USD briefly surpassing the 1.1300 mark although losing some impetus soon afterwards.

EUR/USD bolstered by risk appetite, PMIs

EUR/USD is advancing for the second consecutive session so far on turnaround Tuesday, managing to regain the 1.1300 neighbourhood during early trade. The bullish attempt, however, lacked follow through and sellers dragged the pair back to the current 1.1290/85 band.

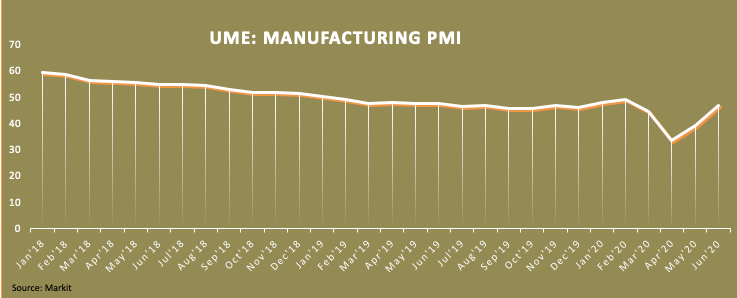

In the meantime, further upside in the pair came after preliminary readings from PMIs in the core eurozone surpassed forecasts for the month of June, adding to the idea that the recovery could (well) be V-shaped. These results add to Monday’s better-than-expected reading from the European Commission’s flash Consumer Confidence, also for the current month.

However, the recent coronavirus outbreaks in Germany and China have prompted some cautiousness among investors and appear to have limited the bull run somewhat.

Later in the NA session, Markit will publish its preliminary Manufacturing PMI seconded by New Home Sales for the month of May.

What to look for around EUR

EUR/USD has started the week on an optimistic mood after bottoming out in the proximity of 1.1170 during last week. In the meantime, investors continue to look to the gradual return to some sort of normality in the Old Continent as well as rising concerns over the probability of a second wave of coronavirus contagion. The constructive view in the euro, however, remains well sustained by the gradual and relentless re-opening of economies in Europe and by the ongoing monetary stimulus announced by the ECB, Germany and the European Commission. On top, the solid performance of the region’s current account is also adding to the attractiveness of the shared currency.

EUR/USD levels to watch

At the moment, the pair is gaining 0.27% at 1.1290 and a break above 1.1306 (weekly high Jun.23) would target 1.1422 (weekly/monthly high Jun.10) en route to 1.1448 (50% Fibo of the 2017-2018 rally). On the other and, immediate contention emerges at 1.1168 (monthly low Jun.19) seconded by 1.1147 (high Mar.27) and finally 1.1028 (200-day SMA).