- The pair extends the upside beyond the 1.1300 handle.

- EMU Industrial Production surprised to the upside in January.

- Brexit vote on ‘no deal’ expected to be rejected later today.

EUR/USD keeps the rally well and sound for yet another session on Wednesday, probing fresh tops beyond the critical 1.1300 the figure although losing some shine afterwards.

EUR/USD bolstered by sentiment, looks to Brexit

The pair keeps the bid tone unchanged since last Friday, managing to regain the 1.1300 barrier and practically fully revert the ECB-led deep pullback to new 2019 lows around 1.1180 (March 7).

In the meantime, the continuation of the upbeat sentiment in the risk-associated universe keeps bolstering the rally in spot despite developments in the US-China trade front have cooled down as of late, particularly after US trade negotiator R.Lighthizer said yesterday that there are ‘major issues’ yet to be resolved in the dispute.

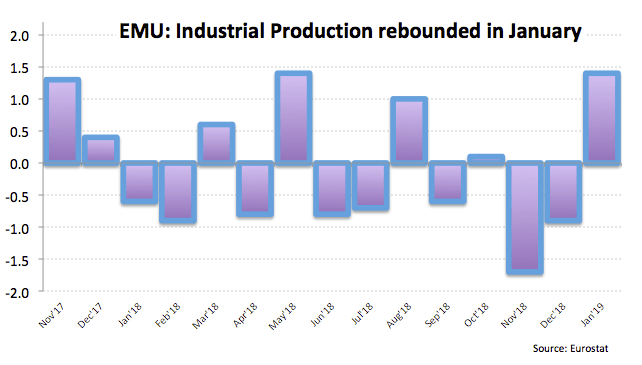

Data wise in Euroland, Industrial Production in the bloc had a promising start of the year, expanding at a monthly 1.4% in January, reverting at the same time December’s contraction. Moving forward, US Durable Goods Orders and Producer Prices are coming up next across the pond.

What to look for around EUR

Market participants appear to have already adjusted to the recent and renewed dovish stance from the ECB, focusing instead on the broad risk-appetite trends as the main driver of the price action in the near term. In the longer run, the performance of the economy in the region should remain in centre stage along with prospects of re-assessment of the ECB’s monetary policy. In this regard, it is worth mentioning that investors keep pricing in the first rate hike by the central bank at some point in H2 2019. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among voters.

EUR/USD levels to watch

At the moment, the pair is gaining 0.07% at 1.1294 and a break above 1.1304 (high Mar.12) would target 1.1311 (21-day SMA) en route to 1.1369 (55-day SMA). On the downside, the next support aligns at 1.1176 (2019 low Mar.7) followed by 1.1118 (monthly low Jun.20 2017) and finally 1.1021 (high May 8 2017).