- The pair trades near 1.1350 following EMU CPI figures.

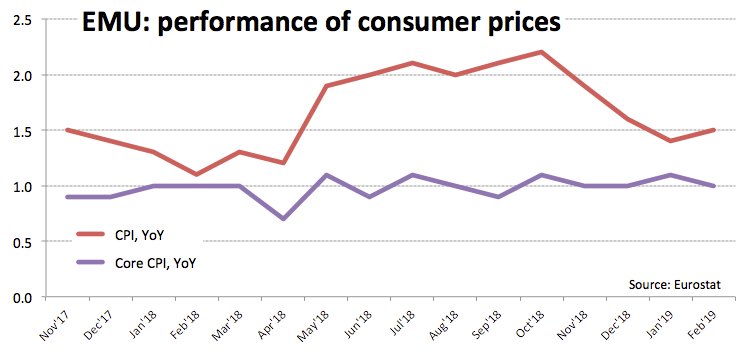

- EMU advanced Core CPI seen at 1.0% YoY in February.

- US ISM manufacturing next of significance in the docket.

The persistent rebound in the demand for the greenback keeps EUR/USD under pressure in the area of daily lows near 1.1350.

EUR/USD offered on data, sentiment

Spot has quickly reverted yesterday’s up move to 3-week highs near 1.1420, sparking the ongoing correction lower to the mid-1.1300s amidst a sudden change of sentiment among market participants.

In addition, and adding to the downbeat mood around EUR, February’s advanced inflation figures tracked by the CPI in Euroland showed consumer prices are expected to rise at an annualized 1.5% and Core prices are seen gaining 1.0% from a year earlier (vs. 1.1% forecasted).

In addition, the unemployment rate in the bloc ticked lower to 7.8% from 7.9%.

What to look for around EUR

The recent upbeat momentum in the single currency has been almost exclusively in response to USD weakness. In the meantime, EUR continues to look to developments from the US-China trade talks for near term direction, while the effervescence on the US-EU trade front appear somewhat relegated so far. Today’s preliminary inflation figures in Euroland added to the already rising speculations that the ECB will remain on a ‘pause’ mode for the rest of the year, always on the back of the ongoing slowdown in the euro zone.

EUR/USD levels to watch

At the moment, the pair is losing 0.03% at 1.1367 and faces the next support at 1.1356 (23.6% Fibo of the September-November drop) seconded by 1.1350 (10-day SMA) and finally 1.1275 (low Feb.19). On the upside, a break above 1.1419 (high Feb.28) would target 1.1442 (38.2% Fibo of the September-November drop) en route to 1.1508 (200-day SMA).