EUR/USD, the world’s most popular currency pair, is moving at a slow rate. This may frustrate many traders who are looking for those long-forgotten big breakouts. However, the comatose pace doesn’t mean choppy trading, at least now in these first days of 2018.

Here is what happened with euro/dollar so far in the new year. It is quite impressive:

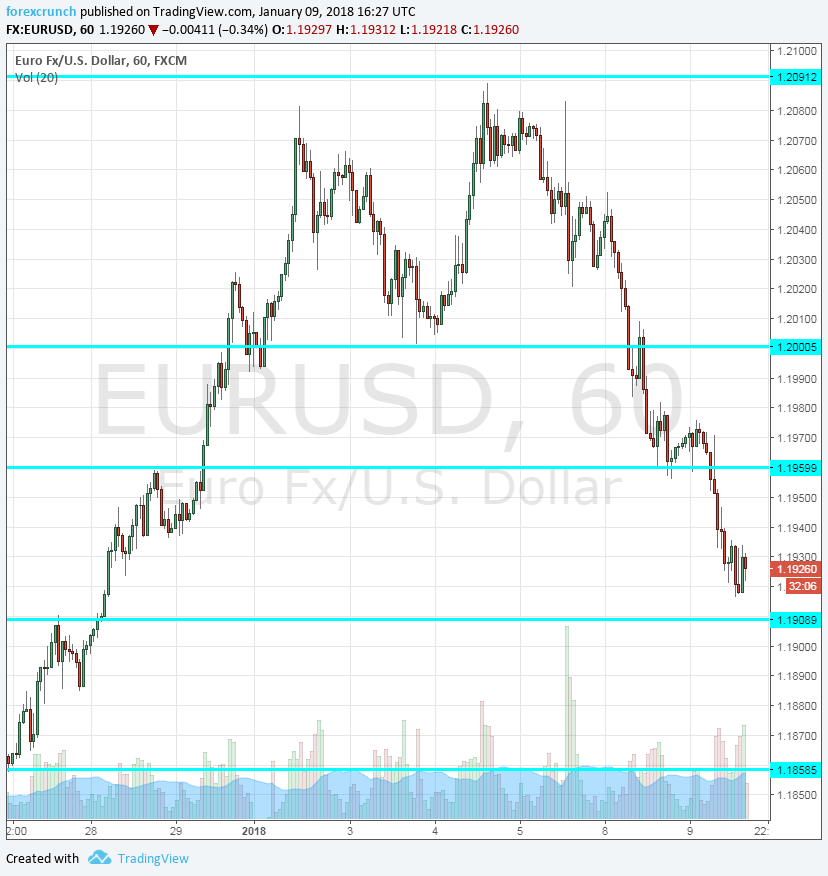

- After breaking above 1.20 in late 2017, EUR/USD slipped to lower ground and found support at 1.20, a round, psychological level of support that capped it in the past.

- After bouncing off 1.20, EUR/USD reached a high of 1.2089 in the first week of 2018, just two pips below the 2017 peak. It doesn’t get closer to this in respecting a key level of resistance.

- A fresh descent followed and EUR/USD made a clear break below 1.20, hitting support at 1.1960. That is exactly where the pair took a break on its way up on December 28th – resistance turned into support.

- After hovering above 1.1960, fresh momentum sent the pair lower. Once again, it stopped at 1.1916, just above resistance turned support at 1.1910, a level which capped the pair on December 27th.

If the pair continues to the downside, 1.1860 is the next level of support. 1.1960 now returns to its previous role as resistance. These levels will test the pair’s behavior once again.

So far, so good. Will this optimal behavior continue?

EUR/USD did not top our 5 most predictable currencies list for Q1 due to the upcoming elections in Italy on March 4th. Yet with the elections still relatively far away, there are reasons to believe that this near-perfect technical behavior may continue for some time.

What do you think?

More: EUR/USD: After losing 1.20, what’s next? 4 opinions