- EUR/USD pulls back from a three-day high.

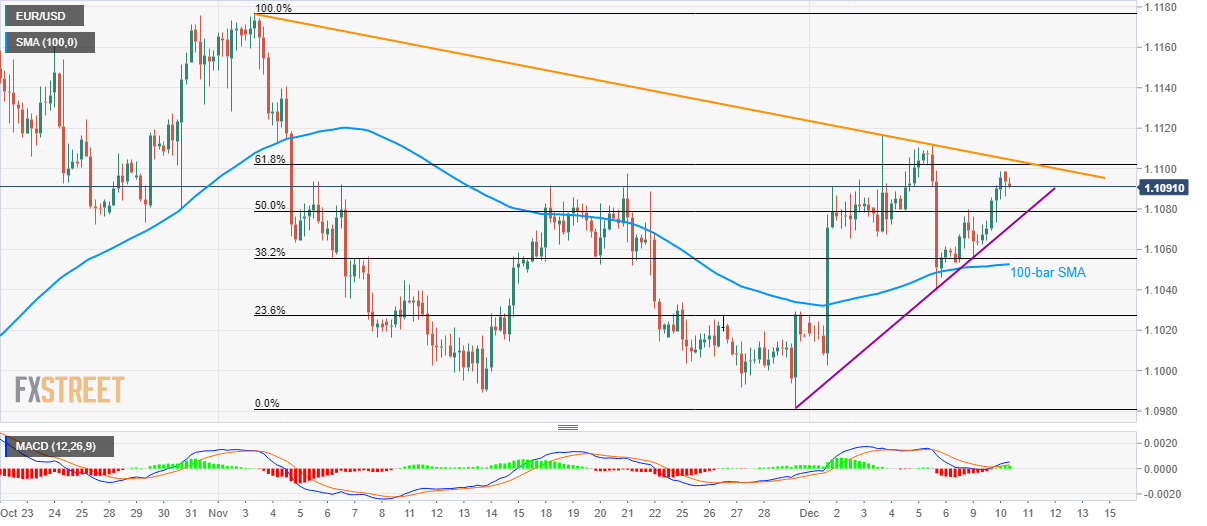

- The eight-day-old rising support line, 100-bar SMA limits near-term declines.

- Bulls can target the monthly top after crossing adjacent resistance confluence.

EUR/USD turns modestly weak to 1.1090 after pulling back from the three-day top during early Wednesday.

The quote now seems to decline towards more than a week-long rising trend line, at 1.1070, whereas 100-bar Simple Moving Average (SMA) near 1.1050/53 could restrict further weakness.

In a case where prices keep trading south after 1.1050, 23.6% Fibonacci retracement of November month fall, at .1027, followed by the previous month low close to 1.0980 can please sellers.

Meanwhile, an upside clearance of 1.1100/05 area including 61.8% Fibonacci retracement and a descending resistance line since early-November can escalate the pair’s recovery 1.1120, surrounding the monthly top.

Additionally, the pair’s rise above 1.1120 needs to cross 1.1140 in order to visit the previous month’s high of 1.1177.

EUR/USD four-hour chart

Trend: Pullback expected