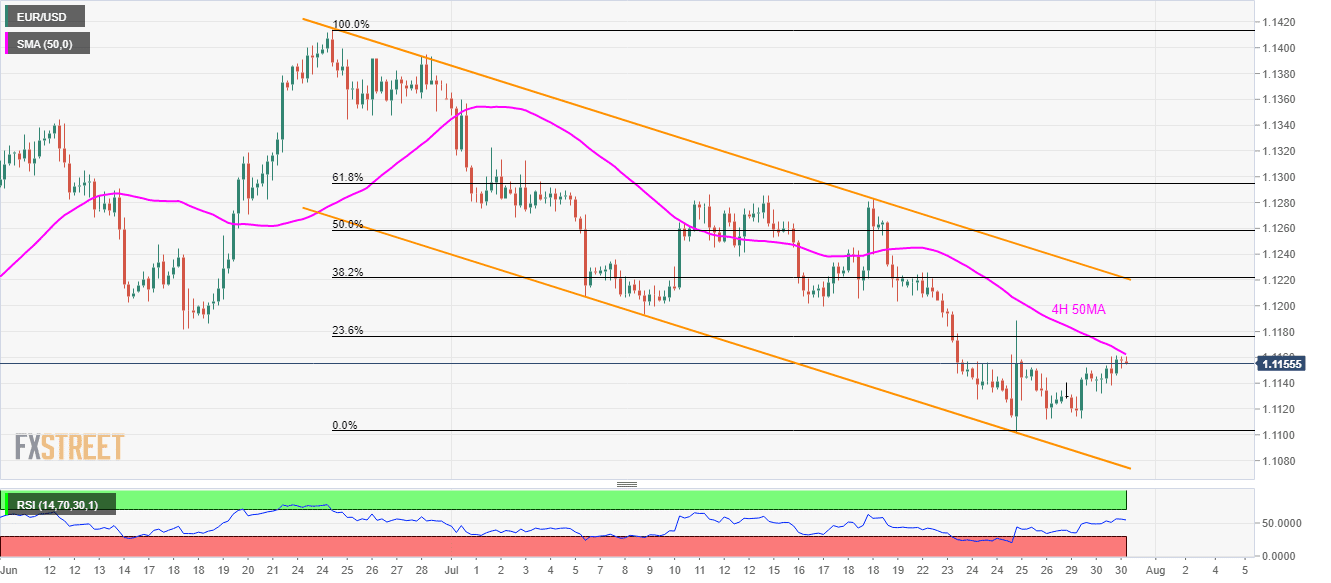

- The falling channel, prices below short-term key moving average portray EUR/USD weakness.

- Bears can keep an eye over 1.1100 unless witnessing a run-up beyond 1.1222 resistance confluence.

The EUR/USD pair’s latest pullback lags behind immediate resistance as the quote seesaws near 1.1158 early on Wednesday morning.

50-bar moving average on the 4-hour chart (4H 50MA), at 1.1162, caps pair’s nearby upside underneath a five-week-old descending trend-channel.

Should prices rise past-1.1162, early-month low close to 1.1195 can entertain buyers ahead of challenging them with 1.1220/22 confluence including channel’s upper-line and 38.2% Fibonacci retracement of late-May to July downpour.

In a case where the bulls manage to overcome 1.1222 resistance, 1.1280 and 61.8% Fibonacci retracement near 1.1295 could flash on their radar.

On the flip side, 1.1130 and the monthly low of 1.1101 hold the gate for the channel’s support-line, at 1.1075 now.

EUR/USD 4-hour chart

Trend: Bearish