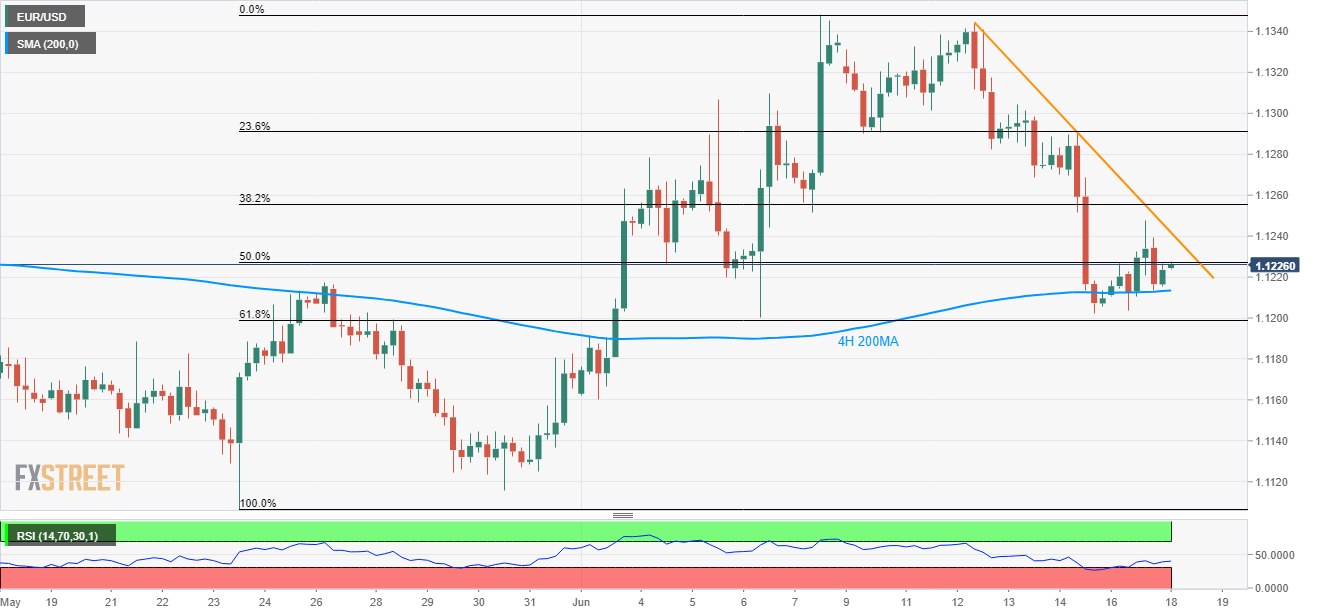

- Buyers target immediate descending trend-line backed by 4H 200MA.

- Failure to cross the resistance may recall early-month lows on the chart.

Successful trading beyond 200-bar moving average (4H 200MA) helps the EUR/USD pair to aim for short-term descending resistance-line as it trades near 1.1230 during the early Asian session on Tuesday.

If prices manage to remain strong above trend-line resistance of 1.1242, 1.1270 and 1.1300 are likely following numbers to appear on the chart.

Given the bulls’ extended rule over 1.1300, current month high near 1.1350 can be targeted if holding long positions.

Meanwhile, the downside break of 4H 200MA level of 1.1213 can fetch the quote to 61.8% Fibonacci retracement level of 1.1200 with 1.1160 being likely follow-on support to grab market attention.

Additionally, pair’s decline below 1.1160 might not refrain from visiting late-May low near 1.1100 round-figure.

EUR/USD 4-Hour chart

Trend: Pullback expected