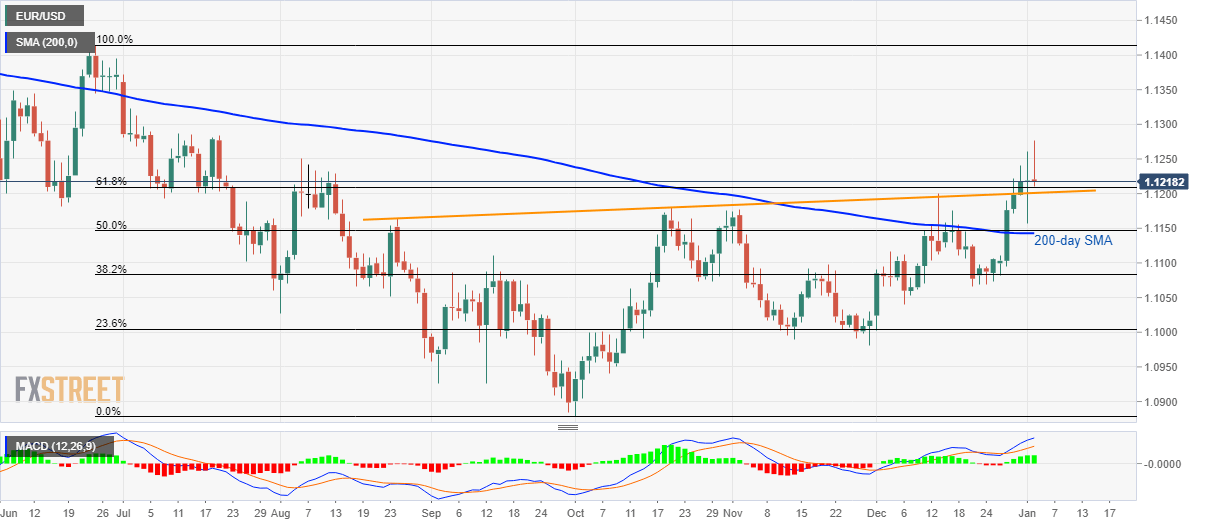

- EUR/USD stays above 61.8% Fibonacci retracement of June-October fall.

- A confluence of 200-day SMA, 50% Fibonacci retracement also becomes the key to watch.

EUR/USD trades mostly unchanged near 1.1220 during early Thursday. The pair remains above key Fibonacci level, i.e. 61.8% Fibonacci retracement of June-October declines, at 1.1210 now.

Not only 61.8% Fibonacci retracement but an upward sloping trend line since late-August (previous support), at 1.1200, also restrict the pair’s near-term declines.

Hence, sellers will look for entry below 1.1200 while targeting a confluence of 200-day SMA and 50% Fibonacci retracement around 1.1143/50.

In a case where the quote slips below 1.1143 on a daily closing basis, December 20 low near 1.1166 will be on the Bears’ radars.

On the contrary, an upside clearance of August month high, at 1.1250, will need validation from July 11 top of 1.1287 to aim for early-June month’s top surrounding 1.1350.

EUR/USD daily chart

Trend: Bullish