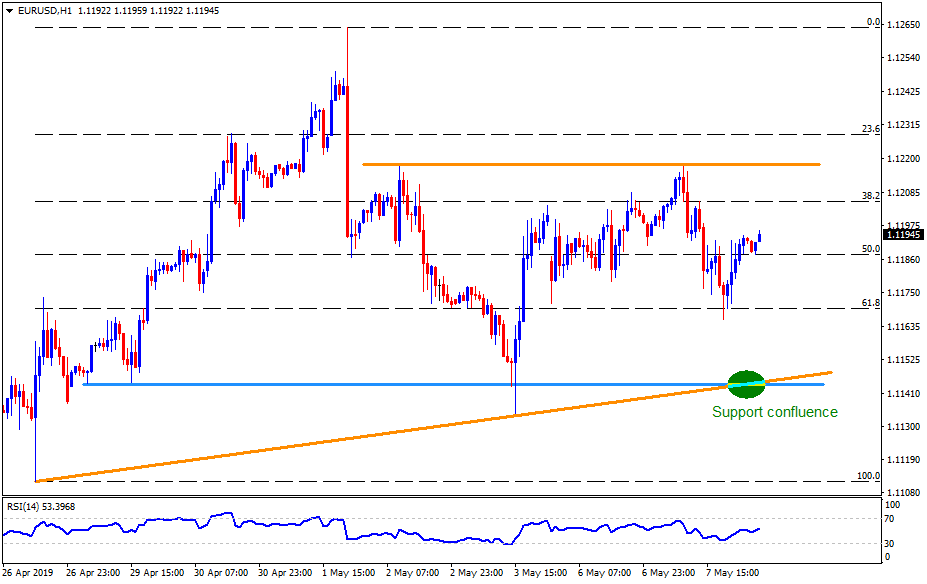

- The sustained trading above 61.8% Fibo and short-term support confluence favor the upside.

- Highs since May 02 can question optimists.

The EUR/USD pair is on the bids around 1.1200 during early Wednesday.

The pair recently took a U-turn from 61.8% Fibonacci retracement of late-April to early-May rise and is presently running towards 1.1220 horizontal resistance surrounded by highs marked since May 02.

If at all the bulls continue dominating trade sentiment above 1.1220, 1.1240, 1.1250 and 1.1265 could flash on their radar.

On the downside, 61.8% Fibonacci retracement near 1.1170 acts as immediate support, a break of which can fetch the quote to 1.1155.

However, 1.1145/40 support-confluence comprising short-term horizontal and ascending trend-lines can limit declines under 1.1155, if not then 1.1130 and 1.1110 should be aimed while holding short positions.

EUR/USD hourly chart

Trend: Positive