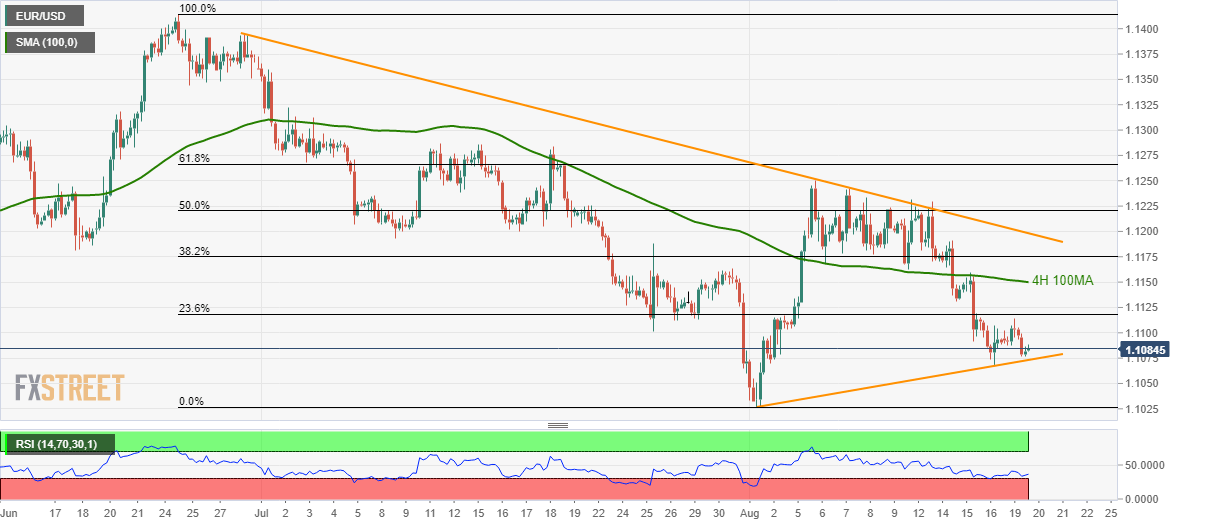

- EUR/USD remains firm above the short-term rising support line.

- 23.6% Fibonacci retracement and 4H 100MA seem near-term key resistances.

Having bounced off 13-day old support-line, EUR/USD takes the bids to 1.1085 during early Tuesday.

Not only its pullback from rising trend-line since August 01 but oversold conditions of 14-bar relative strength index (RSI) also increases the odds for its increase.

In doing so, 23.6% Fibonacci retracement of June-August declines near 1.1120 and 100-bar moving average on the four-hour chart (4H 100MA) at 1.1150, becomes the key to watch.

Should there be increased upside beyond 1.1150, a downward sloping trend-line since late-June, at 1.1200, grabs buyers’ attention.

Alternatively, pair’s break of 1.1070 support-line can quickly fetch it to 1.1055 and then to a recent low near 1.1027. Though, 1.10000 becomes the tough nut to crack for bears during further downside.

EUR/USD 4-hour chart

Trend: Pullback expected