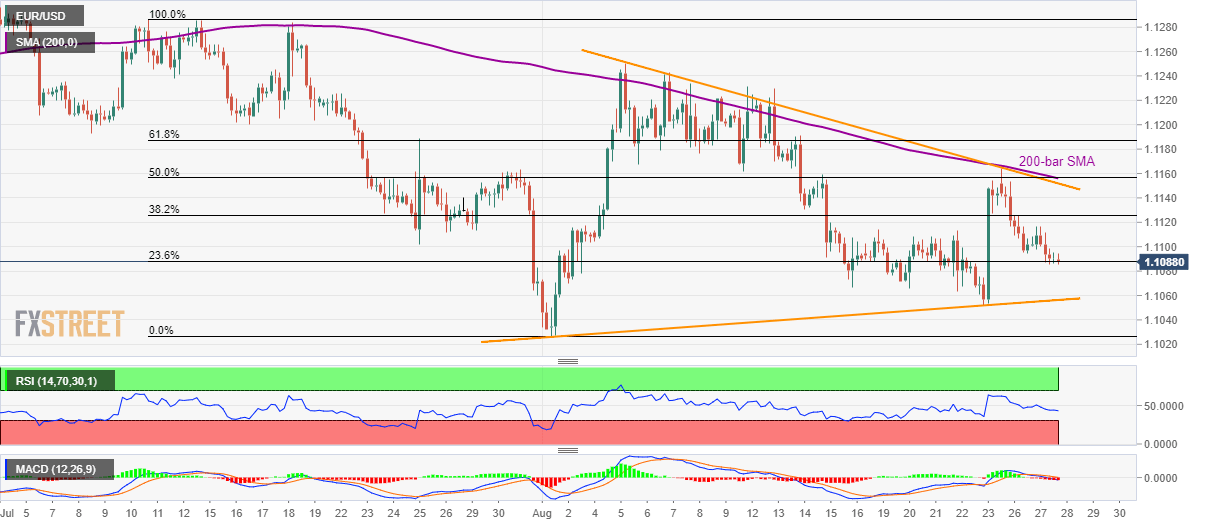

- EUR/USD clings to 23.6% Fibonacci retracement of its downpour since July 11.

- A short-term symmetrical triangle formation limits the pair’s moves.

EUR/USD remains modestly changed while taking rounds to 1.1090 during Wednesday’s Asian session.

The quote recently reversed from resistance-line of a symmetrical triangle formation, which in-turn portrays brighter chances of its pullback to pattern’s support, at 1.1055. However, a clear dip beneath 23.6% Fibonacci retracement level of 1.1088 becomes necessary for the decline.

During the pair’s south-run past-1.1055, monthly low near 1.1027 and 1.1000 round-figure will be on the sellers’ radar.

Meanwhile, 38.2% Fibonacci retracement level of 1.1126 can entertain short-term buyers ahead of challenging them with 1.1152/57 confluence region including 200-bar simple moving average (SMA), 50% Fibonacci retracement and triangle’s upper-line.

It should, however, be noted that pair’s successful break of 1.1157 opens the door for its rally to the early-month top near 1.1250 with 1.1200 likely being an intermediate halt.

EUR/USD 4-hour chart

Trend: Sideways