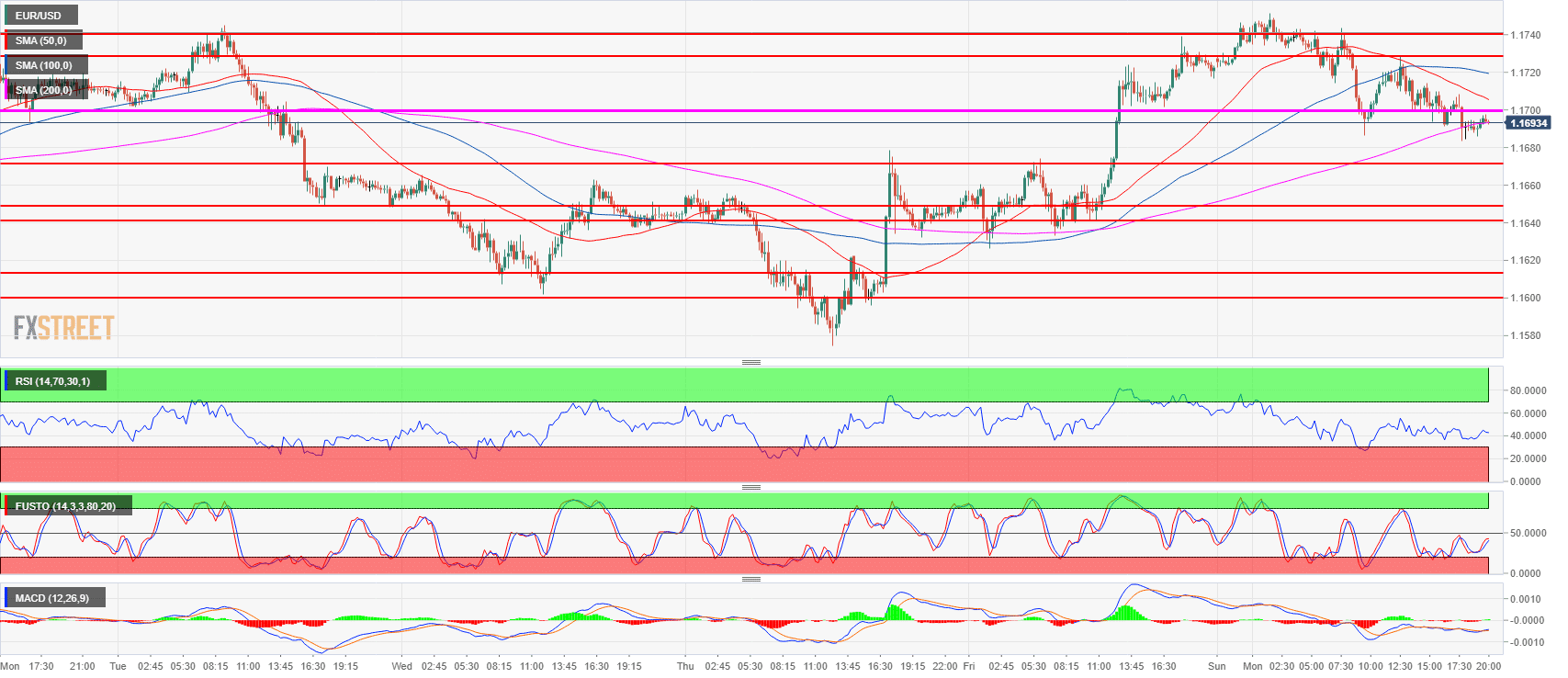

- EUR/USD traded sideways to down throughout this Monday, consolidating the recent 170-pip bull move started last Thursday.

- EUR/USD is forming a bull flag and is consolidating near the 200-period simple moving average (SMA) just below the 1.1700 figure. The next scaling points to the downside are seen in the 1.1640-1.1649 area and 1.1600-1.1613 zone; a bear breakout below that level would likely negate the bullish scenario.

- The bulls objective is to break above 1.1730-1.1740 area in order to initially target the 1.1760-1.1795 zone. The bull case is still in place despite EUR/USD about to close near its low.

Spot rate: 1.1694

Relative change: -0.25%

High: 1.1751

Low: 1.1683

Trend: Bearish / Bullish reversal attempt

Resistance 1: 1.1730-1.1740 area, 23.6% Fibonacci retracement mid-April-May bear move, key level.

Resistance 2: 1.1760-1.1795 supply level

Resistance 3: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672-1.1700 June 27 high and figure

Support 2: 1.1640-1.1649 area, key level and July 12 low

Support 3: 1.1600-1.1613 figure and July 13 low

Support 4: 1.1560 June 14 low

Support 5: 1.1508 current 2018 low

Support 6: 1.1400 figure